vectorbt-案例學習(4)-配對(套利)交易

Portfolio.from_orders構造方法

一、獲取資料

import numpy as np

import pandas as pd

import datetime

import collections

import math

import pytz

import scipy.stats as st

SYMBOL1 = 'PEP'

SYMBOL2 = 'KO'

FROMDATE = datetime.datetime(2017, 1, 1, tzinfo=pytz.utc)

TODATE = datetime.datetime(2019, 1, 1, tzinfo=pytz.utc)

PERIOD = 100

CASH = 100000

COMMPERC = 0.005 # 0.5%

ORDER_PCT1 = 0.1

ORDER_PCT2 = 0.1

UPPER = st.norm.ppf(1 - 0.05 / 2)

LOWER = -st.norm.ppf(1 - 0.05 / 2)

MODE = 'OLS' # OLS, log_return

import vectorbt as vbt

start_date = FROMDATE.replace(tzinfo=pytz.utc)

end_date = TODATE.replace(tzinfo=pytz.utc)

data = vbt.YFData.download([SYMBOL1, SYMBOL2], start=start_date, end=end_date)

data = data.loc[(data.wrapper.index >= start_date) & (data.wrapper.index < end_date)]

二、根據訂單建立投資組合

from numba import njit

# njit為裝飾器,加速運算

@njit

def rolling_logret_zscore_nb(a, b, period):

"""計算a,b(交易對)對數收益率的差值.並進行zscroe標準化"""

spread = np.full_like(a, np.nan, dtype=np.float_)

spread[1:] = np.log(a[1:] / a[:-1]) - np.log(b[1:] / b[:-1])

zscore = np.full_like(a, np.nan, dtype=np.float_)

for i in range(a.shape[0]):

from_i = max(0, i + 1 - period)

to_i = i + 1

if i < period - 1:

continue

spread_mean = np.mean(spread[from_i:to_i])

spread_std = np.std(spread[from_i:to_i])

zscore[i] = (spread[i] - spread_mean) / spread_std

return spread, zscore

@njit

def ols_spread_nb(a, b):

"""最小二乘法計算a,b的回歸殘差(觀測值與OLS回歸線的垂直距離)"""

a = np.log(a)

b = np.log(b)

_b = np.vstack((b, np.ones(len(b)))).T

slope, intercept = np.dot(np.linalg.inv(np.dot(_b.T, _b)), np.dot(_b.T, a))

spread = a - (slope * b + intercept)

return spread[-1]

@njit

def rolling_ols_zscore_nb(a, b, period):

"""對回歸殘差的滾動標準化."""

spread = np.full_like(a, np.nan, dtype=np.float_)

zscore = np.full_like(a, np.nan, dtype=np.float_)

for i in range(a.shape[0]):

from_i = max(0, i + 1 - period)

to_i = i + 1

if i < period - 1:

continue

spread[i] = ols_spread_nb(a[from_i:to_i], b[from_i:to_i])

spread_mean = np.mean(spread[from_i:to_i])

spread_std = np.std(spread[from_i:to_i])

zscore[i] = (spread[i] - spread_mean) / spread_std

return spread, zscore

# 滾動OLS回歸分析

if MODE == 'OLS':

vbt_spread, vbt_zscore = rolling_ols_zscore_nb(

bt_s1_ohlcv['close'].values,

bt_s2_ohlcv['close'].values,

PERIOD

)

#對數收益率差值分析

elif MODE == 'log_return':

vbt_spread, vbt_zscore = rolling_logret_zscore_nb(

bt_s1_ohlcv['close'].values,

bt_s2_ohlcv['close'].values,

PERIOD

)

else:

raise ValueError("Unknown mode")

vbt_spread = pd.Series(vbt_spread, index=bt_s1_ohlcv.index, name='spread')

vbt_zscore = pd.Series(vbt_zscore, index=bt_s1_ohlcv.index, name='zscore')

# 生成入場多空訊號

vbt_short_signals = (vbt_zscore > UPPER).rename('short_signals')

vbt_long_signals = (vbt_zscore < LOWER).rename('long_signals')

vbt_short_signals, vbt_long_signals = pd.Series.vbt.signals.clean(

vbt_short_signals, vbt_long_signals, entry_first=False, broadcast_kwargs=dict(columns_from='keep'))

def plot_spread_and_zscore(spread, zscore):

fig = vbt.make_subplots(rows=2, cols=1, shared_xaxes=True, vertical_spacing=0.05)

spread.vbt.plot(add_trace_kwargs=dict(row=1, col=1), fig=fig)

zscore.vbt.plot(add_trace_kwargs=dict(row=2, col=1), fig=fig)

vbt_short_signals.vbt.signals.plot_as_exit_markers(zscore, add_trace_kwargs=dict(row=2, col=1), fig=fig)

vbt_long_signals.vbt.signals.plot_as_entry_markers(zscore, add_trace_kwargs=dict(row=2, col=1), fig=fig)

fig.update_layout(height=500)

fig.add_shape(

type="rect",

xref='paper',

yref='y2',

x0=0,

y0=UPPER,

x1=1,

y1=LOWER,

fillcolor="gray",

opacity=0.2,

layer="below",

line_width=0,

)

return fig

plot_spread_and_zscore(vbt_spread, vbt_zscore).show_svg()

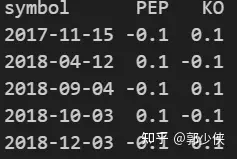

三、根據交易訊號建構訂單

# 根據交易訊號建立訂單

symbol_cols = pd.Index([SYMBOL1, SYMBOL2], name='symbol')

vbt_order_size = pd.DataFrame(index=bt_s1_ohlcv.index, columns=symbol_cols)

vbt_order_size[SYMBOL1] = np.nan

vbt_order_size[SYMBOL2] = np.nan

vbt_order_size.loc[vbt_short_signals, SYMBOL1] = -ORDER_PCT1

vbt_order_size.loc[vbt_long_signals, SYMBOL1] = ORDER_PCT1

vbt_order_size.loc[vbt_short_signals, SYMBOL2] = ORDER_PCT2

vbt_order_size.loc[vbt_long_signals, SYMBOL2] = -ORDER_PCT2

# 下一個bar執行訂單

vbt_order_size = vbt_order_size.vbt.fshift(1)

print(vbt_order_size[~vbt_order_size.isnull().any(axis=1)])

四、進行回測

# 模擬投資組合

vbt_close_price = pd.concat((bt_s1_ohlcv['close'], bt_s2_ohlcv['close']), axis=1, keys=symbol_cols)

vbt_open_price = pd.concat((bt_s1_ohlcv['open'], bt_s2_ohlcv['open']), axis=1, keys=symbol_cols)

def simulate_from_orders():

"""用之前建構的訂單進行回測`."""

return vbt.Portfolio.from_orders(

vbt_close_price, # current close as reference price

size=vbt_order_size,

price=vbt_open_price, # current open as execution price

size_type='targetpercent',

val_price=vbt_close_price.vbt.fshift(1), # previous close as group valuation price

init_cash=CASH,

fees=COMMPERC,

cash_sharing=True, # share capital between assets in the same group

group_by=True, # all columns belong to the same group

call_seq='auto', # sell before buying

freq='d' # index frequency for annualization

)

vbt_pf = simulate_from_orders()

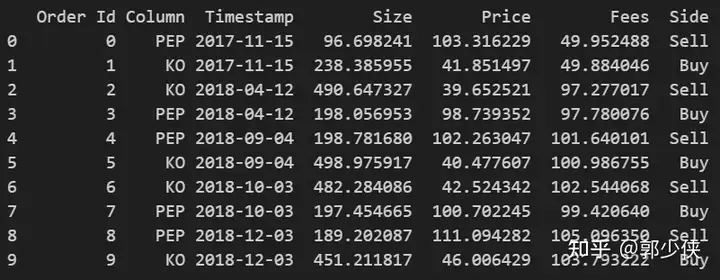

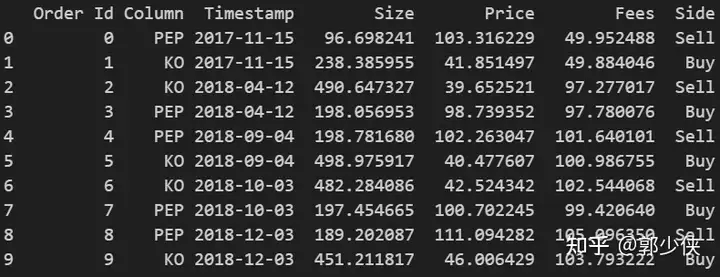

print(vbt_pf.orders.records_readable)

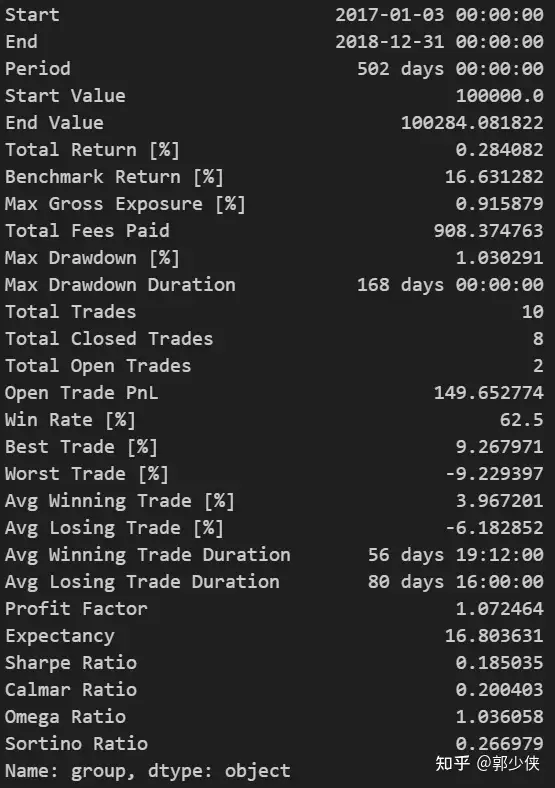

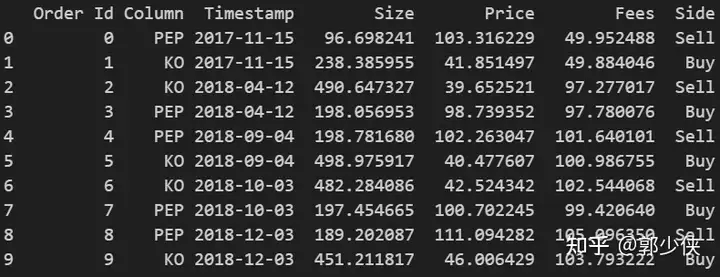

print(vbt_pf.stats())

交易明細

績效統計

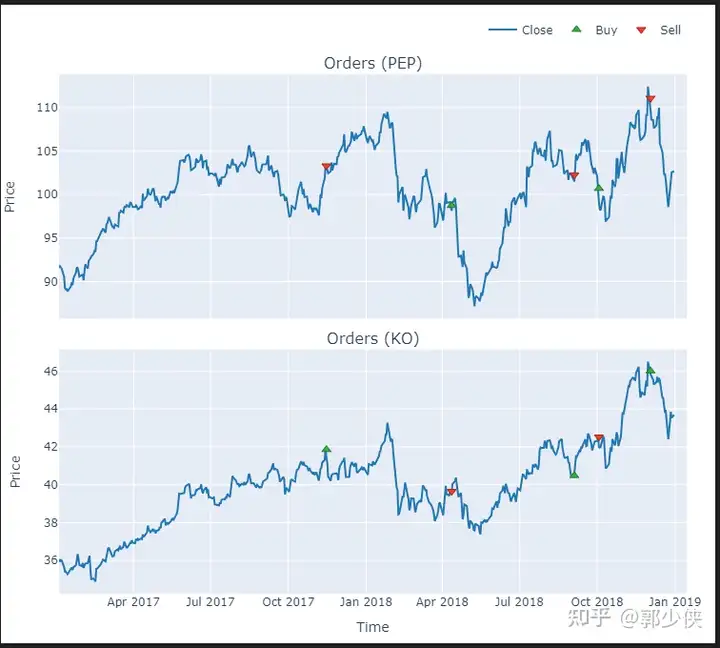

五、繪圖

from functools import partial

def plot_orders(portfolio, column=None, add_trace_kwargs=None, fig=None):

portfolio.orders.plot(column=column, add_trace_kwargs=add_trace_kwargs, fig=fig)

vbt_pf.plot(subplots=[

('symbol1_orders', dict(

title=f"Orders ({SYMBOL1})",

yaxis_title="Price",

check_is_not_grouped=False,

plot_func=partial(plot_orders, column=SYMBOL1),

pass_column=False

)),

('symbol2_orders', dict(

title=f"Orders ({SYMBOL2})",

yaxis_title="Price",

check_is_not_grouped=False,

plot_func=partial(plot_orders, column=SYMBOL2),

pass_column=False

))

]).show_svg()

運行速度:3.72 ms ± 15.9 µs per loop (mean ± std. dev. of 7 runs, 100 loops each)

以上案例為:Portfolio.from_orders構造方法。它非常方便和最佳化的函數用於模擬投資組合,但它需要一些先前的步驟來生成大小陣列。在上面的例子中,需要手動運行散點 Z score的計算,從Z score生成訊號,從訊號建構大小陣列,並確保所有陣列完全對齊。一旦需要測試超過一個超參陣列合,所有這些步驟都必須重複並相應進行調整。

Portfolio.from_order_func構造方法

以下案例為:Portfolio.from_order_func構造方法。 遵循一種不同的(自包含的)方法,其中儘可能多的步驟應該在模擬函數本身中定義。它按順序逐一處理時間戳,並根據使用者定義的邏輯執行訂單,而不是從某些陣列中解析這個邏輯。儘管這使得訂單執行不太透明,因為您不能再即時地分析每一部分資料(Numba 中不能使用 pandas 和繪圖),但它與其他向量化方法相比具有一個重大優勢:事件驅動的訂單處理。這提供了最大的靈活性(可以撰寫任何邏輯)、安全性(降低了暴露自己於前瞻性偏見等其他偏見的可能性)和性能(資料只需要遍歷一次)。這種方法與 backtrader 最為相似

一、主程序

from vectorbt.portfolio import nb as portfolio_nb

from vectorbt.base.reshape_fns import flex_select_auto_nb

from vectorbt.portfolio.enums import SizeType, Direction

from collections import namedtuple

Memory = namedtuple("Memory", ('spread', 'zscore', 'status'))

Params = namedtuple("Params", ('period', 'upper', 'lower', 'order_pct1', 'order_pct2'))

@njit

#該函數為每個組(一對列)準備資料。它初始化陣列以儲存價差、z 分數和狀態。它選擇當前組的參數

#並將它們儲存在一個容器中。

def pre_group_func_nb(c, _period, _upper, _lower, _order_pct1, _order_pct2):

"""Prepare the current group (= pair of columns)."""

assert c.group_len == 2

# 與bt相比,vbt不建立實例,而是儲存在陣列裡

# 建立spread和zscore陣列:這些陣列用於儲存價差和z分數。它們被初始化為NaN,長度為c.target_shape[0],

#即資料的長度。

spread = np.full(c.target_shape[0], np.nan, dtype=np.float_)

zscore = np.full(c.target_shape[0], np.nan, dtype=np.float_)

# status陣列:這個陣列用於儲存狀態資訊,初始化為0。

# 將spread、zscore和status陣列組合成一個命名元組,作為儲存資料的容器。

status = np.full(1, 0, dtype=np.int_)

memory = Memory(spread, zscore, status)

# 將傳入的參數_period、_upper、_lower、_order_pct1、_order_pct2轉換成陣列,並根據組的索引選擇對應的值。

#這樣可以確保每個組可以有不同的參數組態。

period = flex_select_auto_nb(np.asarray(_period), 0, c.group, True)

upper = flex_select_auto_nb(np.asarray(_upper), 0, c.group, True)

lower = flex_select_auto_nb(np.asarray(_lower), 0, c.group, True)

order_pct1 = flex_select_auto_nb(np.asarray(_order_pct1), 0, c.group, True)

order_pct2 = flex_select_auto_nb(np.asarray(_order_pct2), 0, c.group, True)

# 把所有參數放入容器

params = Params(period, upper, lower, order_pct1, order_pct2)

# 儲存 pre_segment_func_nb 函數中要用到的兩個目標百分比。這個陣列的長度為當前組的長度

size = np.empty(c.group_len, dtype=np.float_)

return (memory, params, size)

@njit

def pre_segment_func_nb(c, memory, params, size, mode):

"""預處理分段資料"""

# 檢查是否達到指定窗口大小

if c.i < params.period - 1:

size[0] = np.nan # size of nan means no order

size[1] = np.nan

return (size,)

#窗口切片:用於計算zscore

window_slice = slice(max(0, c.i + 1 - params.period), c.i + 1)

# 根據不同模式計算價差spread

if mode == 'OLS':

a = c.close[window_slice, c.from_col]

b = c.close[window_slice, c.from_col + 1]

memory.spread[c.i] = ols_spread_nb(a, b)

elif mode == 'log_return':

logret_a = np.log(c.close[c.i, c.from_col] / c.close[c.i - 1, c.from_col])

logret_b = np.log(c.close[c.i, c.from_col + 1] / c.close[c.i - 1, c.from_col + 1])

memory.spread[c.i] = logret_a - logret_b

else:

raise ValueError("Unknown mode")

spread_mean = np.mean(memory.spread[window_slice])

spread_std = np.std(memory.spread[window_slice])

memory.zscore[c.i] = (memory.spread[c.i] - spread_mean) / spread_std

# 根據 z-score 是否超過設定的上下界,確定要執行的交易操作。

#如果 z-score 超過了上界,則賣出第一列資產並買入第二列資產;

#如果 z-score 低於下界,則買入第一列資產並賣出第二列資產。

if memory.zscore[c.i - 1] > params.upper and memory.status[0] != 1:

size[0] = -params.order_pct1

size[1] = params.order_pct2

c.call_seq_now[0] = 0

c.call_seq_now[1] = 1

memory.status[0] = 1

elif memory.zscore[c.i - 1] < params.lower and memory.status[0] != 2:

size[0] = params.order_pct1

size[1] = -params.order_pct2

c.call_seq_now[0] = 1 # execute the second order first to release funds early

c.call_seq_now[1] = 0

memory.status[0] = 2

else:

size[0] = np.nan

size[1] = np.nan

# 根據執行順序 call_seq_now,決定先執行哪一筆交易。這裡指定了先執行賣出操作,再執行買入操作,以及先執行買入操作,再執行賣出操作的情況

c.last_val_price[c.from_col] = c.close[c.i - 1, c.from_col]

c.last_val_price[c.from_col + 1] = c.close[c.i - 1, c.from_col + 1]

return (size,)

@njit

def order_func_nb(c, size, price, commperc):

"""生成訂單."""

group_col = c.col - c.from_col

return portfolio_nb.order_nb(

size=size[group_col],

price=price[c.i, c.col],

size_type=SizeType.TargetPercent,

fees=commperc

)

#主程序,用Portfolio.from_order_func回測策略

def simulate_from_order_func():

"""用Portfolio.from_order_func回測策略`."""

return vbt.Portfolio.from_order_func(

vbt_close_price,

order_func_nb,

vbt_open_price.values, COMMPERC, # *args for order_func_nb

pre_group_func_nb=pre_group_func_nb,

pre_group_args=(PERIOD, UPPER, LOWER, ORDER_PCT1, ORDER_PCT2),

pre_segment_func_nb=pre_segment_func_nb,

pre_segment_args=(MODE,),

fill_pos_record=False, # a bit faster

init_cash=CASH,

cash_sharing=True,

group_by=True,

freq='d'

)

vbt_pf2 = simulate_from_order_func()

%timeit simulate_from_order_func()

運行速度:4.4 ms ± 17.3 µs per loop (mean ± std. dev. of 7 runs, 100 loops each)

二、最佳化速度-加入numba:

def simulate_nb_from_order_func():

"""用`portfolio_nb`回測."""

# iterate over 502 rows and 2 columns, each element is a potential order

target_shape = vbt_close_price.shape

# number of columns in the group - exactly two

group_lens = np.array([2])

# build default call sequence (orders are executed from the left to the right column)

call_seq = portfolio_nb.build_call_seq(target_shape, group_lens)

# initial cash per group

init_cash = np.array([CASH], dtype=np.float_)

order_records, log_records = portfolio_nb.simulate_nb(

target_shape=target_shape,

group_lens=group_lens,

init_cash=init_cash,

cash_sharing=True,

call_seq=call_seq,

segment_mask=np.full(target_shape, True), # used for disabling some segments

pre_group_func_nb=pre_group_func_nb,

pre_group_args=(PERIOD, UPPER, LOWER, ORDER_PCT1, ORDER_PCT2),

pre_segment_func_nb=pre_segment_func_nb,

pre_segment_args=(MODE,),

order_func_nb=order_func_nb,

order_args=(vbt_open_price.values, COMMPERC),

close=vbt_close_price.values, # used for target percentage, but we override the valuation price

fill_pos_record=False

)

return target_shape, group_lens, call_seq, init_cash, order_records, log_records

target_shape, group_lens, call_seq, init_cash, order_records, log_records = simulate_nb_from_order_func()

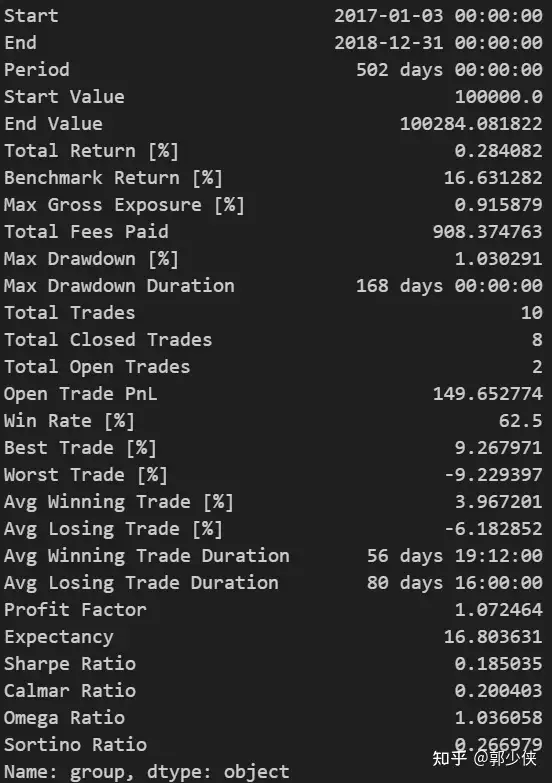

print(vbt.Orders(vbt_close_price.vbt.wrapper, order_records, vbt_close_price).records_readable)

vbt_pf3 = vbt.Portfolio(

wrapper=vbt_close_price.vbt(freq='d', group_by=True).wrapper,

close=vbt_close_price,

order_records=order_records,

log_records=log_records,

init_cash=init_cash,

cash_sharing=True,

call_seq=call_seq

)

print(vbt_pf3.stats())

列印績效統計

運行速度:2.3 ms ± 9.23 µs per loop (mean ± std. dev. of 7 runs, 100 loops each)