低波動 飆股長相

def compute_candle_volatility(timeperiod=20):

close = data.get("price:收盤價")

high = data.get("price:最高價")

low = data.get("price:最低價")

open_ = data.get("price:開盤價")

bullish_candle = close >= open_

bullish_volatility = (

abs(close.shift() - open_)

+ abs(open_ - low)

+ abs(low - high)

+ abs(high - close)

)

bearish_volatility = (

abs(close.shift() - open_)

+ abs(open_ - high)

+ abs(high - low)

+ abs(low - close)

)

candle_volatility = FinlabDataFrame(

np.nan, index=close.index, columns=close.columns

)

candle_volatility[bullish_candle] = bullish_volatility

candle_volatility[~bullish_candle] = bearish_volatility

volatility = (

candle_volatility.average(timeperiod) / close.average(timeperiod) * 100

)

return volatility

收盤價跟月營收合併

import finlab

import pandas as pd

from finlab import data

pd.options.display.float_format = lambda x: "%.2f" % x

if __name__ == "__main__":

close = data.get("price:收盤價")

rev = data.get("monthly_revenue:當月營收")

print(close)

print(rev)

merged_df = close.merge(rev, on='date', how='left', suffixes=('_close', '_rev'))

merged_df.fillna(method='bfill', inplace=True)

print(merged_df, merged_df.columns)

print(merged_df['2330_close'], merged_df['2330_rev'])

臺股漲跌與市值板塊圖

出處: https://www.finlab.tw/dashboard2-plotly-treemap/

import pandas as pd

import numpy as np

import finlab

from finlab import data

import plotly.express as px

"""

https://www.finlab.tw/dashboard2-plotly-treemap/

Treemap

"""

def df_date_filter(df, start=None, end=None):

if start:

df = df[df.index >= start]

if end:

df = df[df.index <= end]

return df

def create_treemap_data(start, end, item, clip=None):

close = data.get("price:收盤價")

basic_info = data.get("company_basic_info")

turnover = data.get("price:成交金額")

close_data = df_date_filter(close, start, end)

turnover_data = df_date_filter(turnover, start, end).iloc[1:].sum() / 100000000

return_ratio = (

(close_data.iloc[-1] / close_data.iloc[-2]).dropna().replace(np.inf, 0)

)

return_ratio = round((return_ratio - 1) * 100, 2)

concat_list = [close_data.iloc[-1], turnover_data, return_ratio]

col_names = ["stock_id", "close", "turnover", "return_ratio"]

if item not in ["return_ratio", "turnover_ratio"]:

try:

custom_item = df_date_filter(data.get(item), start, end).iloc[-1].fillna(0)

except Exception as e:

logger.error("data error, check the data is existed between start and end.")

logger.error(e)

return None

if clip:

custom_item = custom_item.clip(*clip)

concat_list.append(custom_item)

col_names.append(item)

df = pd.concat(concat_list, axis=1).dropna()

df = df.reset_index()

df.columns = col_names

basic_info_df = basic_info.copy()

basic_info_df["stock_id_name"] = basic_info_df["stock_id"] + basic_info_df["公司簡稱"]

df = df.merge(

basic_info_df[["stock_id", "stock_id_name", "產業類別", "市場別", "實收資本額(元)"]],

how="left",

on="stock_id",

)

df = df.rename(columns={"產業類別": "category", "市場別": "market", "實收資本額(元)": "base"})

df = df.dropna(thresh=5)

df["market_value"] = round(df["base"] / 10 * df["close"] / 100000000, 2)

df["turnover_ratio"] = df["turnover"] / (df["turnover"].sum()) * 100

df["country"] = "TW-Stock"

return df

def plot_tw_stock_treemap(

start=None,

end=None,

area_ind="market_value",

item="return_ratio",

clip=None,

color_scales="Temps",

):

"""Plot treemap chart for tw_stock

Treemap charts visualize hierarchical data using nested rectangles,

it is good for judging the overall market dynamics.

Args:

start(str): The date of data start point.ex:2021-01-02

end(str):The date of data end point.ex:2021-01-05

area_ind(str):The indicator to control treemap area size .

Select range is in ["market_value","turnover","turnover_ratio"]

item(str): The indicator to control treemap area color .

Select range is in ["return_ratio", "turnover_ratio"]

or use the other customized data which you could find from finlab database page,

ex:'price_earning_ratio:本益比'

clip(tuple):lower and upper pd.clip() setting for item values to make distinct colors.ex:(0,100)

color_scales(str):Used for the built-in named continuous

(sequential, diverging and cyclical) color scales in Plotly

Ref:https://plotly.com/python/builtin-colorscales/

Returns:

figure

"""

df = create_treemap_data(start, end, item, clip)

if df is None:

return None

df["custom_item_label"] = round(df[item], 2).astype(str)

if area_ind not in ["market_value", "turnover", "turnover_ratio"]:

return None

if item in ["return_ratio"]:

color_continuous_midpoint = 0

else:

color_continuous_midpoint = np.average(df[item], weights=df[area_ind])

fig = px.treemap(

df,

path=["country", "market", "category", "stock_id_name"],

values=area_ind,

color=item,

color_continuous_scale=color_scales,

color_continuous_midpoint=color_continuous_midpoint,

custom_data=["custom_item_label", "close", "turnover"],

title=f"TW-Stock Market TreeMap({start}~{end})"

f"---area_ind:{area_ind}---item:{item}",

width=1600,

height=800,

)

fig.update_traces(

textposition="middle center",

textfont_size=24,

texttemplate="%{label}(%{customdata[1]})<br>%{customdata[0]}",

)

return fig

if __name__ == "__main__":

# @title 臺股漲跌與市值板塊圖

start = "2021-07-01" # @param {type:"date"}

end = "2021-07-02" # @param {type:"date"}

area_ind = "turnover_ratio" # @param ["market_value","turnover","turnover_ratio"] {allow-input: true}

item = (

"return_ratio" # @param ["return_ratio", "turnover_ratio"] {allow-input: true}

)

clip = 1000 # @param {type:"number"}

plot_tw_stock_treemap(start, end, area_ind, item, clip)

finlab 的 mae gmfe bmfe

以 2063 世鎧 mae 是 0 代表 2023-01-03 進場~ 2023-02-01 出場 的所有日K open 價都高過 進場當天開盤價

是以進場價格做基準點~ 藏獒策略以開盤價進場 開盤價出場

| trade_index | stock_id | entry_date | exit_date | entry_sig_date | exit_sig_date | return | trade_price@entry_date | trade_price@exit_date | mae | gmfe | bmfe | mdd | return_include_fee |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 630 | 2063 世鎧 | 2023-01-03 | 2023-02-01 | 2022-12-30 | 2023-01-31 | 0.0159 | 43.9000 | 44.6000 | 0.0000 | 0.0342 | 0.0000 | -0.0287 | 1.0000 |

| 631 | 3498 陽程 | 2023-01-03 | 2023-02-01 | 2022-12-30 | 2023-01-31 | -0.0225 | 37.8000 | 36.9500 | -0.0542 | 0.0582 | 0.0582 | -0.1062 | -2.8200 |

| 632 | 8996 高力 | 2023-01-03 | 2023-02-01 | 2022-12-30 | 2023-01-31 | 0.1568 | 185.0000 | 214.0000 | -0.0270 | 0.1568 | 0.0270 | -0.0526 | 15.0000 |

| 633 | 1104 環泥 | 2023-02-01 | 2023-03-01 | 2023-01-31 | 2023-02-24 | 0.0253 | 23.7000 | 24.3000 | -0.0042 | 0.0316 | 0.0274 | -0.0308 | 1.9300 |

| 634 | 1707 葡萄王 | 2023-01-03 | 2023-03-01 | 2022-12-30 | 2023-02-24 | 0.0737 | 169.5000 | 182.0000 | -0.0619 | 0.0737 | 0.0000 | -0.0619 | 6.7500 |

| 635 | 2727 王品 | 2023-02-01 | 2023-03-01 | 2023-01-31 | 2023-02-24 | 0.4865 | 185.0000 | 275.0000 | 0.0000 | 0.4865 | 0.0000 | -0.0455 | 47.7800 |

| 636 | 6612 奈米醫材 | 2023-02-01 | 2023-03-01 | 2023-01-31 | 2023-02-24 | 0.2284 | 116.0000 | 142.5000 | 0.0000 | 0.3405 | 0.0000 | -0.0870 | 22.1300 |

| 637 | 2916 滿心 | 2023-03-01 | 2023-04-06 | 2023-02-24 | 2023-03-31 | -0.0046 | 32.8000 | 32.6500 | -0.0244 | 0.0549 | 0.0549 | -0.0751 | -1.0400 |

| 638 | 3004 豐達科 | 2023-03-01 | 2023-04-06 | 2023-02-24 | 2023-03-31 | 0.0650 | 89.2000 | 93.9000 | -0.0695 | 0.0650 | 0.0381 | -0.1037 | 4.6500 |

| 639 | 3052 夆典 | 2023-03-01 | 2023-04-06 | 2023-02-24 | 2023-03-31 | -0.0560 | 11.6000 | 10.9500 | -0.0560 | 0.0000 | 0.0000 | -0.0560 | -6.1500 |

| 640 | 6664 群翊 | 2023-03-01 | 2023-04-06 | 2023-02-24 | 2023-03-31 | 0.0648 | 108.0000 | 115.0000 | -0.0648 | 0.0648 | 0.0000 | -0.0648 | 5.8600 |

| 641 | 8931 大汽電 | 2023-02-01 | 2023-04-06 | 2023-01-31 | 2023-03-31 | 0.6282 | 46.8000 | 76.2000 | 0.0000 | 0.7286 | 0.0000 | -0.0581 | 61.8700 |

| 642 | 3078 僑威 | 2023-04-06 | nan | 2023-03-31 | 2023-04-30 | 0.2362 | 44.2500 | 54.7000 | -0.0147 | 0.3107 | 0.0000 | -0.0569 | 22.8900 |

| 643 | 3540 曜越 | 2023-04-06 | nan | 2023-03-31 | 2023-04-30 | 0.0773 | 38.8000 | 41.8000 | -0.0052 | 0.1521 | 0.0013 | -0.0649 | 7.1000 |

| 644 | 4119 旭富 | 2023-04-06 | nan | 2023-03-31 | 2023-04-30 | 0.0496 | 121.0000 | 127.0000 | 0.0000 | 0.0992 | 0.0000 | -0.0451 | 4.3500 |

| 645 | 4153 鈺緯 | 2023-04-06 | nan | 2023-03-31 | 2023-04-30 | 0.1000 | 48.0000 | 52.8000 | 0.0000 | 0.2625 | 0.0000 | -0.1287 | 9.3600 |

| 646 | 4190 佐登-KY | 2023-04-06 | nan | 2023-03-31 | 2023-04-30 | 0.0741 | 94.5000 | 101.5000 | -0.0169 | 0.1111 | 0.0000 | -0.0333 | 6.7800 |

# -*- coding: utf-8 -*-

"""correlationMatrix.ipynb

Automatically generated by Colaboratory.

Original file is located at

https://colab.research.google.com/drive/1jmq3ycgp65_NURP8cY3vg2SvTDXc5X8n

"""

#!pip install yfinance > log.txt

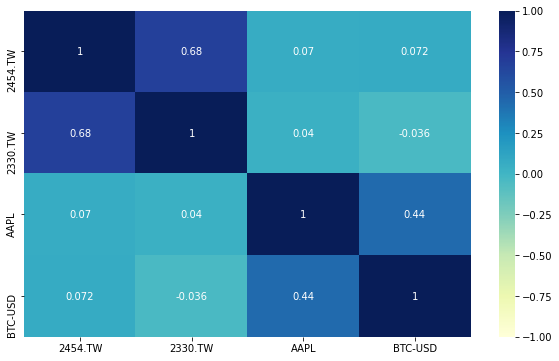

#@title 輸入 Yahoo 股票代號(例如: 2330.TW, AAPL, BTC-USD)

stock_ids = "2454.TW,2330.TW, AAPL, BTC-USD" #@param {type:"string"}

import yfinance as yf

import time

import pandas as pd

stocks = stock_ids.replace(' ', '').split(',')

price = {}

for s in stocks:

print(f'download {s}')

ss = yf.Ticker(s)

# get historical market data

hist = ss.history(period='1y')

price[s] = hist['Close']

time.sleep(3)

import seaborn

import matplotlib.pyplot as plt

plt.rcParams['figure.figsize'] = (10, 6)

seaborn.heatmap(pd.DataFrame(price).pct_change().dropna(how='any').corr(), cmap="YlGnBu",vmax=1,vmin=-1, annot=True)

finlab策略

from finlab import data

from finlab.backtest import sim

import pandas as pd

import redis

import finlab

def connect_redis():

r = None

pool = redis.ConnectionPool(host="localhost", port=6379, db=8)

try:

r = redis.Redis(connection_pool=pool, charset="utf-8")

except Exception as err:

logger.error(err)

return r

# rs = connect_redis()

# rs.flushdb()

finlab.login("")

score = data.get('etl:finlab_tw_stock_market_ind')['score']

close = data.get("price:收盤價")

vol = data.get("price:成交股數")

vol_ma = vol.average(10)

rev = data.get('monthly_revenue:當月營收')

rev_year_growth = data.get('monthly_revenue:去年同月增減(%)')

rev_month_growth = data.get('monthly_revenue:上月比較增減(%)')

# 股價創年新高

cond1 = (close == close.rolling(250).max())

# 排除月營收連3月衰退10%以上

cond2 = ~(rev_year_growth < -10).sustain(3)

# 排除月營收成長趨勢過老(12個月內有至少8個月單月營收年增率大於60%)

cond3 = ~(rev_year_growth > 60).sustain(12,8)

# 確認營收底部,近月營收脫離近年穀底(連續3月的"單月營收近12月最小值/近月營收" < 0.8)

cond4 = ((rev.rolling(12).min())/(rev) < 0.8).sustain(3)

# 單月營收月增率連續3月大於-40%

cond5 = (rev_month_growth > -40).sustain(3)

# 流動性條件

cond6 = vol_ma > 200*1000

buy = cond1 & cond2 & cond3 & cond4 & cond5 & cond6

# 買比較冷門的股票

buy = vol_ma*buy

buy = buy[buy>0]

buy = buy.is_smallest(5)

long_position = buy.resample('M').last().reindex(close.index,method='ffill')

score_df = score >= 4

long_position *= score_df

# 做空訊號~多單遇大盤訊號轉空時出場,並反手做空指數避險

short_target = '00632R'

short_position = close[[short_target]].notna() * ~score_df

position = pd.concat([long_position, short_position], axis=1)

report = sim(position, upload=True, position_limit=1/3, fee_ratio=1.425/1000/3, stop_loss=0.08, trade_at_price='open' ,name='XXXX', live_performance_start='2022-06-01')

print(report.get_trades().to_markdown())

from finlab import data

from finlab.backtest import sim

import finlab

finlab.login("")

close = data.get("price:收盤價")

vol = data.get("price:成交股數")

vol_ma = vol.average(10)

rev = data.get('monthly_revenue:當月營收')

rev_year_growth = data.get('monthly_revenue:去年同月增減(%)')

rev_month_growth = data.get('monthly_revenue:上月比較增減(%)')

# 股價創年新高

cond1 = (close == close.rolling(250).max())

# 排除月營收連3月衰退10%以上

cond2 = ~(rev_year_growth < -10).sustain(3)

# 排除月營收成長趨勢過老(12個月內有至少8個月單月營收年增率大於60%)

cond3 = ~(rev_year_growth > 60).sustain(12,8)

# 確認營收底部(單月營收月增率連續3月大於-40)

cond4 = ((rev.rolling(12).min())/(rev) < 0.8).sustain(3)

# 單月營收月增率連續3月大於-40%

cond5 = (rev_month_growth > -40).sustain(3)

# 流動性條件

cond6 = vol_ma > 200*1000

buy = cond1 & cond2 & cond3 & cond4 & cond5 & cond6

# 買比較冷門的股票

buy = vol_ma*buy

buy = buy[buy>0]

buy = buy.is_smallest(5)

report = sim(buy , resample="M", upload=True, position_limit=1/3, fee_ratio=1.425/1000/3, stop_loss=0.08, trade_at_price='open',name='XXX', live_performance_start='2022-05-01')

print(report.get_trades().to_markdown())

from loguru import logger

from finlab import data

from finlab.backtest import sim

import finlab

import pandas as pd

import pickle

import redis

import zlib

def data_to_redis(r):

score = data.get("etl:finlab_tw_stock_market_ind")["score"]

close = data.get("price:收盤價")

vol = data.get("price:成交股數")

vol_ma = vol.average(10)

rev = data.get("monthly_revenue:當月營收")

rev_year_growth = data.get("monthly_revenue:去年同月增減(%)")

rev_month_growth = data.get("monthly_revenue:上月比較增減(%)")

EXPIRATION_SECONDS = 86400

# Set

r.setex("score", EXPIRATION_SECONDS, zlib.compress(pickle.dumps(score)))

r.setex("close", EXPIRATION_SECONDS, zlib.compress(pickle.dumps(close)))

r.setex("vol", EXPIRATION_SECONDS, zlib.compress(pickle.dumps(vol)))

r.setex("vol_ma", EXPIRATION_SECONDS, zlib.compress(pickle.dumps(vol_ma)))

r.setex("rev", EXPIRATION_SECONDS, zlib.compress(pickle.dumps(rev)))

r.setex(

"rev_year_growth",

EXPIRATION_SECONDS,

zlib.compress(pickle.dumps(rev_year_growth)),

)

r.setex(

"rev_month_growth",

EXPIRATION_SECONDS,

zlib.compress(pickle.dumps(rev_month_growth)),

)

def backtest(r):

# Get

score_df = pickle.loads(zlib.decompress(r.get("score")))

close_df = pickle.loads(zlib.decompress(r.get("close")))

vol_df = pickle.loads(zlib.decompress(r.get("vol")))

vol_ma_df = pickle.loads(zlib.decompress(r.get("vol_ma")))

rev_df = pickle.loads(zlib.decompress(r.get("rev")))

rev_year_growth_df = pickle.loads(zlib.decompress(r.get("rev_year_growth")))

rev_month_growth_df = pickle.loads(zlib.decompress(r.get("rev_month_growth")))

# print(score_df)

# print(close_df)

# print(vol_df)

# print(vol_ma_df)

# print(rev_df)

# print(rev_year_growth_df)

# print(rev_month_growth_df)

# 股價創年新高

cond1 = close_df == close_df.rolling(250).max()

# 排除月營收連3月衰退10%以上

cond2 = ~(rev_year_growth_df < -10).sustain(3)

# 排除月營收成長趨勢過老(12個月內有至少8個月單月營收年增率大於60%)

cond3 = ~(rev_year_growth_df > 60).sustain(12, 8)

# 確認營收底部,近月營收脫離近年穀底(連續3月的"單月營收近12月最小值/近月營收" < 0.8)

cond4 = ((rev_df.rolling(12).min()) / (rev_df) < 0.8).sustain(3)

# 單月營收月增率連續3月大於-40%

cond5 = (rev_month_growth_df > -40).sustain(3)

# 流動性條件

cond6 = vol_ma_df > 200 * 1000

buy = cond1 & cond2 & cond3 & cond4 & cond5 & cond6

# 買比較冷門的股票

buy = vol_ma_df * buy

buy = buy[buy > 0]

buy = buy.is_smallest(5)

long_position = buy.resample("M").last().reindex(close_df.index, method="ffill")

score_df = score_df >= 4

long_position *= score_df

# 做空訊號~多單遇大盤訊號轉空時出場,並反手做空指數避險

short_target = "00632R"

short_position = close_df[[short_target]].notna() * ~score_df

position = pd.concat([long_position, short_position], axis=1)

report = sim(

position,

upload=True,

position_limit=1 / 3,

fee_ratio=1.425 / 1000 / 3,

stop_loss=0.08,

trade_at_price="open",

name="XXXXX",

live_performance_start="2022-06-01",

)

# print(report.get_stats())

def connect_redis():

pool = redis.ConnectionPool(host="localhost", port=6379, db=0)

try:

r = redis.Redis(connection_pool=pool, charset="utf-8")

except Exception as err:

logger.error(err)

return r

if __name__ == "__main__":

finlab.login(

""

)

r = connect_redis()

# data_to_redis(r)

backtest(r)

highcharts_股價走勢.ipynb

https://colab.research.google.com/drive/1W1kH3cwNUTj7hMMyF8W4wcehiWLSyAUF?usp=sharing#scrollTo=Mij5sRmwbtCP

import yfinance as yf

# 取得股價歷史資料(含臺股\美股\加密貨幣)

symbol = '2330.TW' # 臺股上市:TW 臺股上櫃:TWO

start = '2018-01-01' # 起始時間

end = '2022-12-31' # 結束時間

ohlcv = yf.Ticker(symbol).history('max').loc[start:end]

from highcharts import Highchart

import datetime

from IPython.display import HTML,display

import os

# 客製化調整參數

color = '#4285f4' # 線的顏色 (red/green/blue/purple)

linewidth = 2 # 線的粗細

title = symbol # 標題名稱

width = 800 # 圖的寬度

height = 500 # 圖的高度

# 繪圖設定

H = Highchart(width=width,height=height)

x = ohlcv.index

y = round(ohlcv.Close,2)

data = [[index,s] for index,s in zip(x,y)]

H.add_data_set(data,'line','data',color=color)

H.set_options('xAxis',{'type':'datetime'})

H.set_options('title',{'text':title,'style':{'color':'black'}}) # 設定title

H.set_options('plotOptions',{'line':{'lineWidth':linewidth,'dataLabels':{'enabled': False}}}) # 設定線的粗度

H.set_options('tooltip',{'shared':True,'crosshairs':True}) # 設定為可互動式

# 顯示圖表

H.save_file('chart')

display(HTML('chart.html'))

os.remove('chart.html')

突破策略豆知識 | 如何避免假突破?

https://colab.research.google.com/drive/1M0XxnAMZoqoOrJQP9dyJVer5Q7YyRFOA?usp=sharing

https://www.finlab.tw/breakthrough_stock_picking_strategies/

# -*- coding: utf-8 -*-

"""股價創新高動能.ipynb

Automatically generated by Colaboratory.

Original file is located at

https://colab.research.google.com/drive/1M0XxnAMZoqoOrJQP9dyJVer5Q7YyRFOA

## 安裝套件

"""

# Commented out IPython magic to ensure Python compatibility.

# %%capture

# !pip install finlab > log.txt

# !pip install talib-binary > log.txt

"""## 股價創新高動能"""

from finlab.backtest import sim

from finlab import data

# 標的範圍為上市櫃普通股

with data.universe(market='TSE_OTC'):

# 取得收盤價

close = data.get("price:收盤價")

# 股價創近200日新高

position = (close == close.rolling(200).max())

# 每兩週再平衡,單檔最大持股比例限制20%,停損20%

report = sim(position, resample="2W", position_limit=0.2, stop_loss=0.2, name="股價創新高策略", upload=False)

report.display()

"""## 創新高延續動能策略

"""

from finlab.backtest import sim

from finlab import data

with data.universe(market='TSE_OTC'):

close = data.get("price:收盤價")

# 近5日內有3日以上的股價創前200日新高

position = (close == close.rolling(200).max()).sustain(5,3)

report = sim(position, resample="2W", position_limit=0.2, stop_loss=0.2, name="創新高延續動能策略", upload=False)

report.display()

import yfinance as yf

# 下載臺積電股票資料

df = yf.download("2317.TW", start="2014-01-01", end="2023-01-01")

# 將時間單位轉換為月份,取得每個月份的最後一筆資料,並填補缺失值

df = df.resample("M").last().bfill()

# 根據原始資料的時間索引重新排序,並填補缺失值

df = df.reindex(df.index, method="bfill")

print(df)

- FinlabDataFrame

from finlab.utils import logger

import datetime

import numpy as np

import pandas as pd

from finlab import data

import functools

class FinlabDataFrame(pd.DataFrame):

"""回測語法糖

除了使用熟悉的 Pandas 語法外,我們也提供很多語法糖,讓大家開發程式時,可以用簡易的語法完成複雜的功能,讓開發策略更簡潔!

我們將所有的語法糖包裹在 `FinlabDataFrame` 中,用起來跟 `pd.DataFrame` 一樣,但是多了很多功能!

只要使用 `finlab.data.get()` 所獲得的資料,皆為 `FinlabDataFrame` 格式,

接下來我們就來看看, `FinlabDataFrame` 有哪些好用的語法糖吧!

當資料日期沒有對齊(例如: 財報 vs 收盤價 vs 月報)時,在使用以下運算符號:`+`, `-`, `*`, `/`, `>`, `>=`, `==`, `<`, `<=`, `&`, `|`, `~`,不需要先將資料對齊,因為 `FinlabDataFrame` 會自動幫你處理,以下是示意圖。

<img src="https://i.ibb.co/pQr5yx5/Screen-Shot-2021-10-26-at-5-32-44-AM.png" alt="Screen-Shot-2021-10-26-at-5-32-44-AM">

以下是範例:`cond1` 與 `cond2` 分別為「每天」,和「每季」的資料,假如要取交集的時間,可以用以下語法:

```py

from finlab import data

# 取得 FinlabDataFrame

close = data.get('price:收盤價')

roa = data.get('fundamental_features:ROA稅後息前')

# 運算兩個選股條件交集

cond1 = close > 37

cond2 = roa > 0

cond_1_2 = cond1 & cond2

擷取 1101 臺泥 的訊號如下圖,可以看到 `cond1` 跟 `cond2` 訊號的頻率雖然不相同,但是由於 `cond1` 跟 `cond2` 是 `FinlabDataFrame`,所以可以直接取交集,而不用處理資料頻率對齊的問題。

<br />

<img src="https://i.ibb.co/m9chXSQ/imageconds.png" alt="imageconds">

總結來說,FinlabDataFrame 與一般 dataframe 唯二不同之處:

1. 多了一些 method,如`df.is_largest()`, `df.sustain()`...等。

2. 在做四則運算、不等式運算前,會將 df1、df2 的 index 取聯集,column 取交集。

"""

@property

def _constructor(self):

return FinlabDataFrame

@staticmethod

def reshape(df1, df2):

isfdf1 = isinstance(df1, FinlabDataFrame)

isfdf2 = isinstance(df2, FinlabDataFrame)

isdf1 = isinstance(df1, pd.DataFrame)

isdf2 = isinstance(df2, pd.DataFrame)

both_are_dataframe = (isfdf1 + isdf1) * (isfdf2 + isdf2) != 0

d1_index_freq = df1.get_index_str_frequency() if isfdf1 else None

d2_index_freq = df2.get_index_str_frequency() if isfdf2 else None

if ((d1_index_freq or d2_index_freq)

and (d1_index_freq != d2_index_freq)

and both_are_dataframe):

df1 = df1.index_str_to_date() if isfdf1 else df1

df2 = df2.index_str_to_date() if isfdf2 else df2

if isinstance(df2, pd.Series):

df2 = pd.DataFrame({c: df2 for c in df1.columns})

if both_are_dataframe:

index = df1.index.union(df2.index)

columns = df1.columns.intersection(df2.columns)

if len(df1.index) * len(df2.index) != 0:

index_start = max(df1.index[0], df2.index[0])

index = [t for t in index if index_start <= t]

return df1.reindex(index=index, method='ffill')[columns], \

df2.reindex(index=index, method='ffill')[columns]

else:

return df1, df2

def __lt__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__lt__(df1, df2)

def __gt__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__gt__(df1, df2)

def __le__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__le__(df1, df2)

def __ge__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__ge__(df1, df2)

def __eq__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__eq__(df1, df2)

def __ne__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__ne__(df1, df2)

def __sub__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__sub__(df1, df2)

def __add__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__add__(df1, df2)

def __mul__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__mul__(df1, df2)

def __truediv__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__truediv__(df1, df2)

def __rshift__(self, other):

return self.shift(-other)

def __lshift__(self, other):

return self.shift(other)

def __and__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__and__(df1, df2)

def __or__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__or__(df1, df2)

def __getitem__(self, other):

df1, df2 = self.reshape(self, other)

return pd.DataFrame.__getitem__(df1, df2)

def index_str_to_date(self):

"""財務月季報索引格式轉換

將以下資料的索引轉換成datetime格式:

月營收 (ex:2022-M1) 從文字格式轉為公告截止日。

財務季報 (ex:2022-Q1) 從文字格式轉為財報電子檔資料上傳日。

通常使用情境為對不同週期的dataframe做reindex,常用於以公告截止日作為訊號產生日。

Returns:

(pd.DataFrame): data

Examples:

```py

data.get('monthly_revenue:當月營收').index_str_to_date()

data.get('financial_statement:現金及約當現金').index_str_to_date()

```

"""

if len(self.index) == 0 or not isinstance(self.index[0], str):

return self

if self.index[0].find('M') != -1:

return self._index_str_to_date_month()

elif self.index[0].find('Q') != -1:

return self._index_str_to_date_season()

return self

@staticmethod

def to_business_day(date):

def skip_weekend(d):

add_days = {5: 2, 6: 1}

wd = d.weekday()

if wd in add_days: d += datetime.timedelta(days=add_days[wd])

return d

close = data.get('price:收盤價')

return pd.Series(date).apply(lambda d: skip_weekend(d) if d in close.index or d < close.index[0] or d > close.index[-1] else close.loc[d:].index[0]).values

def get_index_str_frequency(self):

if len(self.index) == 0:

return None

if not isinstance(self.index[0], str):

return None

if (self.index.str.find('M') != -1).all():

return 'month'

if (self.index.str.find('Q') != -1).all():

return 'season'

return None

def _index_date_to_str_month(self):

# index is already str

if len(self.index) == 0 or not isinstance(self.index[0], pd.Timestamp):

return self

index = (self.index - datetime.timedelta(days=30)).strftime('%Y-M%m')

return FinlabDataFrame(self.values, index=index, columns=self.columns)

def _index_str_to_date_month(self):

# index is already timestamps

if len(self.index) == 0 or not isinstance(self.index[0], str):

return self

if not (self.index.str.find('M') != -1).all():

logger.warning('FinlabDataFrame: invalid index, cannot format index to monthly timestamp.')

return self

index = pd.to_datetime(self.index, format='%Y-M%m') + pd.offsets.MonthBegin() + datetime.timedelta(days=9)

# chinese new year and covid-19 impact monthly revenue deadline

replacements = {

datetime.datetime(2020, 2, 10): datetime.datetime(2020, 2, 15),

datetime.datetime(2021, 2, 10): datetime.datetime(2021, 2, 15),

datetime.datetime(2022, 2, 10): datetime.datetime(2022, 2, 14),

}

replacer = replacements.get

index = [replacer(n, n) for n in index]

index = self.to_business_day(index)

ret = FinlabDataFrame(self.values, index=index, columns=self.columns)

ret.index.name = 'date'

return ret

def _index_date_to_str_season(self):

# index is already str

if len(self.index) == 0 or not isinstance(self.index[0], pd.Timestamp):

return self

q = self.index.strftime('%m').astype(int).map({5:1, 8:2, 9:2, 10:3, 11:3, 3:4, 4:4})

year = self.index.year.copy()

year -= (q == 4)

index = year.astype(str) + '-Q' + q.astype(str)

return FinlabDataFrame(self.values, index=index, columns=self.columns)

def deadline(self):

"""財務季報索引轉換成公告截止日

將財務季報 (ex:2022Q1) 從文字格式轉為公告截止日的datetime格式,

通常使用情境為對不同週期的dataframe做reindex,常用於以公告截止日作為訊號產生日。

Returns:

(pd.DataFrame): data

Examples:

```py

data.get('financial_statement:現金及約當現金').deadline()

```

"""

return self._index_str_to_date_season(detail=False)

def _index_str_to_date_season(self, detail=True):

disclosure_dates = (calc_disclosure_dates(detail)

.reindex_like(self)

.unstack())

self.columns.name = 'stock_id'

unstacked = self.unstack()

ret = (pd.DataFrame({

'value': unstacked.values,

'disclosures': disclosure_dates.values,

}, unstacked.index)

.reset_index()

.drop_duplicates(['disclosures', 'stock_id'])

.pivot(index='disclosures', columns='stock_id', values='value').ffill()

.pipe(lambda df: df.loc[df.index.notna()])

.pipe(lambda df: FinlabDataFrame(df))

.rename_axis('date')

)

if not detail:

ret.index = self.to_business_day(ret.index)

return ret

def average(self, n):

"""取 n 筆移動平均

若股票在時間窗格內,有 N/2 筆 NaN,則會產生 NaN。

Args:

n (positive-int): 設定移動窗格數。

Returns:

(pd.DataFrame): data

Examples:

股價在均線之上

```py

from finlab import data

close = data.get('price:收盤價')

sma = close.average(10)

cond = close > sma

```

只需要簡單的語法,就可以將其中一部分的訊號繪製出來檢查:

```py

import matplotlib.pyplot as plt

close.loc['2021', '2330'].plot()

sma.loc['2021', '2330'].plot()

cond.loc['2021', '2330'].mul(20).add(500).plot()

plt.legend(['close', 'sma', 'cond'])

```

<img src="https://i.ibb.co/Mg1P85y/sma.png" alt="sma">

"""

return self.rolling(n, min_periods=int(n/2)).mean()

def is_largest(self, n):

"""取每列前 n 筆大的數值

若符合 `True` ,反之為 `False` 。用來篩選每天數值最大的股票。

<img src="https://i.ibb.co/8rh3tbt/is-largest.png" alt="is-largest">

Args:

n (positive-int): 設定每列前 n 筆大的數值。

Returns:

(pd.DataFrame): data

Examples:

每季 ROA 前 10 名的股票

```py

from finlab import data

roa = data.get('fundamental_features:ROA稅後息前')

good_stocks = roa.is_largest(10)

```

"""

return self.astype(float).apply(lambda s: s.nlargest(n), axis=1).reindex_like(self).notna()

def is_smallest(self, n):

"""取每列前 n 筆小的數值

若符合 `True` ,反之為 `False` 。用來篩選每天數值最小的股票。

Args:

n (positive-int): 設定每列前 n 筆小的數值。

Returns:

(pd.DataFrame): data

Examples:

股價淨值比最小的 10 檔股票

```py

from finlab import data

pb = data.get('price_earning_ratio:股價淨值比')

cheap_stocks = pb.is_smallest(10)

```

"""

return self.astype(float).apply(lambda s: s.nsmallest(n), axis=1).reindex_like(self).notna()

def is_entry(self):

"""進場點

取進場訊號點,若符合條件的值則為True,反之為False。

Returns:

(pd.DataFrame): data

Examples:

策略為每日收盤價前10高,取進場點。

```py

from finlab import data

data.get('price:收盤價').is_largest(10).is_entry()

```

"""

return (self & ~self.shift(fill_value=False))

def is_exit(self):

"""出場點

取出場訊號點,若符合條件的值則為 True,反之為 False。

Returns:

(pd.DataFrame): data

Examples:

策略為每日收盤價前10高,取出場點。

```py

from finlab import data

data.get('price:收盤價').is_largest(10).is_exit()

```

"""

return (~self & self.shift(fill_value=False))

def rise(self, n=1):

"""數值上升中

取是否比前第n筆高,若符合條件的值則為True,反之為False。

<img src="https://i.ibb.co/Y72bN5v/Screen-Shot-2021-10-26-at-6-43-41-AM.png" alt="Screen-Shot-2021-10-26-at-6-43-41-AM">

Args:

n (positive-int): 設定比較前第n筆高。

Returns:

(pd.DataFrame): data

Examples:

收盤價是否高於10日前股價

```py

from finlab import data

data.get('price:收盤價').rise(10)

```

"""

return self > self.shift(n)

def fall(self, n=1):

"""數值下降中

取是否比前第n筆低,若符合條件的值則為True,反之為False。

<img src="https://i.ibb.co/Y72bN5v/Screen-Shot-2021-10-26-at-6-43-41-AM.png" alt="Screen-Shot-2021-10-26-at-6-43-41-AM">

Args:

n (positive-int): 設定比較前第n筆低。

Returns:

(pd.DataFrame): data

Examples:

收盤價是否低於10日前股價

```py

from finlab import data

data.get('price:收盤價').fall(10)

```

"""

return self < self.shift(n)

def groupby_category(self):

"""資料按產業分群

類似 `pd.DataFrame.groupby()`的處理效果。

Returns:

(pd.DataFrame): data

Examples:

半導體平均股價淨值比時間序列

```py

from finlab import data

pe = data.get('price_earning_ratio:股價淨值比')

pe.groupby_category().mean()['半導體'].plot()

```

<img src="https://i.ibb.co/Tq2fKBp/pbmean.png" alt="pbmean">

全球 2020 量化寬鬆加上晶片短缺,使得半導體股價淨值比衝高。

"""

categories = data.get('security_categories')

cat = categories.set_index('stock_id').category.to_dict()

org_set = set(cat.values())

set_remove_illegal = set(

o for o in org_set if isinstance(o, str) and o != 'nan')

set_remove_illegal

refine_cat = {}

for s, c in cat.items():

if c == None or c == 'nan':

refine_cat[s] = '其他'

continue

if c == '電腦及週邊':

refine_cat[s] = '電腦及週邊設備業'

continue

if c[-1] == '業' and c[:-1] in set_remove_illegal:

refine_cat[s] = c[:-1]

else:

refine_cat[s] = c

col_categories = pd.Series(self.columns.map(

lambda s: refine_cat[s] if s in cat else '其他'))

return self.groupby(col_categories.values, axis=1)

def entry_price(self, trade_at='close'):

signal = self.is_entry()

adj = data.get('etl:adj_close') if trade_at == 'close' else data.get(

'etl:adj_open')

adj, signal = adj.reshape(

adj.loc[signal.index[0]: signal.index[-1]], signal)

return adj.bfill()[signal.shift(fill_value=False)].ffill()

def sustain(self, nwindow, nsatisfy=None):

"""持續 N 天滿足條件

取移動 nwindow 筆加總大於等於nsatisfy,若符合條件的值則為True,反之為False。

Args:

nwindow (positive-int): 設定移動窗格。

nsatisfy (positive-int): 設定移動窗格計算後最低滿足數值。

Returns:

(pd.DataFrame): data

Examples:

收盤價是否連兩日上漲

```py

from finlab import data

data.get('price:收盤價').rise().sustain(2)

```

"""

nsatisfy = nsatisfy or nwindow

return self.rolling(nwindow).sum() >= nsatisfy

def industry_rank(self, categories=None):

"""計算產業 ranking 排名,0 代表產業內最低,1 代表產業內最高

Args:

categories (list of str): 欲考慮的產業,ex: ['貿易百貨', '雲端運算'],預設為全產業,請參考 `data.get('security_industry_themes')` 中的產業項目。

Examples:

本意比產業排名分數

```py

from finlab import data

pe = data.get('price_earning_ratio:本益比')

pe_rank = pe.industry_rank()

print(pe_rank)

```

"""

themes = (data.get('security_industry_themes')

.copy() # 複製

.assign(category=lambda self: self.category

.apply(lambda s: eval(s))) # 從文字格式轉成陣列格

.explode('category') # 展開資料

)

categories = (categories

or set(themes.category[themes.category.str.find(':') == -1]))

def calc_rank(ind):

stock_ids = themes.stock_id[themes.category == ind]

return (self[stock_ids].pipe(lambda self: self.rank(axis=1, pct=True)))

return (pd.concat([calc_rank(ind) for ind in categories],axis=1)

.groupby(level=0, axis=1).mean())

def quantile_row(self, c):

"""股票當天數值分位數

取得每列c定分位數的值。

Args:

c (positive-int): 設定每列 n 定分位數的值。

Returns:

(pd.DataFrame): data

Examples:

取每日股價前90%分位數

```py

from finlab import data

data.get('price:收盤價').quantile_row(0.9)

```

"""

s = self.quantile(c, axis=1)

return s

def exit_when(self, exit):

df, exit = self.reshape(self, exit)

df.fillna(False, inplace=True)

exit.fillna(False, inplace=True)

entry_signal = df.is_entry()

exit_signal = df.is_exit()

exit_signal |= exit

# build position using entry_signal and exit_signal

position = pd.DataFrame(np.nan, index=df.index, columns=df.columns)

position[entry_signal] = 1

position[exit_signal] = 0

position.ffill(inplace=True)

position = position == 1

position.fillna(False)

return position

def hold_until(self, exit, nstocks_limit=None, stop_loss=-np.inf, take_profit=np.inf, trade_at='close', rank=None):

"""訊號進出場

這大概是所有策略撰寫中,最重要的語法糖,上述語法中 `entries` 為進場訊號,而 `exits` 是出場訊號。所以 `entries.hold_until(exits)` ,就是進場訊號為 `True` 時,買入並持有該檔股票,直到出場訊號為 `True ` 則賣出。

<img src="https://i.ibb.co/PCt4hPd/Screen-Shot-2021-10-26-at-6-35-05-AM.png" alt="Screen-Shot-2021-10-26-at-6-35-05-AM">

此函式有很多細部設定,可以讓你最多選擇 N 檔股票做輪動。另外,當超過 N 檔進場訊號發生,也可以按照客製化的排序,選擇優先選入的股票。最後,可以設定價格波動當輪動訊號,來增加出場的時機點。

Args:

exit (pd.Dataframe): 出場訊號。

nstocks_limit (int)`: 輪動檔數上限,預設為None。

stop_loss (float): 價格波動輪動訊號,預設為None,不生成輪動訊號。範例:0.1,代表成本價下跌 10% 時產生出場訊號。

take_profit (float): 價格波動輪動訊號,預設為None,不生成輪動訊號。範例:0.1,代表成本價上漲 10% 時產生出場訊號。

trade_at (str): 價格波動輪動訊號參考價,預設為'close'。可選 `close` 或 `open`。

rank (pd.Dataframe): 當天進場訊號數量超過 nstocks_limit 時,以 rank 數值越大的股票優先進場。

Returns:

(pd.DataFrame): data

Examples:

價格 > 20 日均線入場, 價格 < 60 日均線出場,最多持有10檔,超過 10 個進場訊號,則以股價淨值比小的股票優先選入。

```python

from finlab import data

from finlab.backtest import sim

close = data.get('price:收盤價')

pb = data.get('price_earning_ratio:股價淨值比')

sma20 = close.average(20)

sma60 = close.average(60)

entries = close > sma20

exits = close < sma60

#pb前10小的標的做輪動

position = entries.hold_until(exits, nstocks_limit=10, rank=-pb)

sim(position)

```

"""

if nstocks_limit is None:

nstocks_limit = len(self.columns)

union_index = self.index.union(exit.index)

intersect_col = self.columns.intersection(exit.columns)

if stop_loss != -np.inf or take_profit != np.inf:

price = data.get(f'etl:adj_{trade_at}')

union_index = union_index.union(

price.loc[union_index[0]: union_index[-1]].index)

intersect_col = intersect_col.intersection(price.columns)

else:

price = pd.DataFrame()

if rank is not None:

union_index = union_index.union(rank.index)

intersect_col = intersect_col.intersection(rank.columns)

entry = self.reindex(union_index, columns=intersect_col,

method='ffill').ffill().fillna(False)

exit = exit.reindex(union_index, columns=intersect_col,

method='ffill').ffill().fillna(False)

if price is not None:

price = price.reindex(

union_index, columns=intersect_col, method='ffill')

if rank is not None:

rank = rank.reindex(

union_index, columns=intersect_col, method='ffill')

else:

rank = pd.DataFrame(1, index=union_index, columns=intersect_col)

max_rank = rank.max().max()

min_rank = rank.min().min()

rank = (rank - min_rank) / (max_rank - min_rank)

rank.fillna(0, inplace=True)

def rotate_stocks(ret, entry, exit, nstocks_limit, stop_loss=-np.inf, take_profit=np.inf, price=None, ranking=None):

nstocks = 0

ret[0][np.argsort(entry[0])[-nstocks_limit:]] = 1

ret[0][exit[0] == 1] = 0

ret[0][entry[0] == 0] = 0

entry_price = np.empty(entry.shape[1])

entry_price[:] = np.nan

for i in range(1, entry.shape[0]):

# regitser entry price

if stop_loss != -np.inf or take_profit != np.inf:

is_entry = ((ret[i-2] == 0) if i >

1 else (ret[i-1] == 1))

is_waiting_for_entry = np.isnan(entry_price) & (ret[i-1] == 1)

is_entry |= is_waiting_for_entry

entry_price[is_entry == 1] = price[i][is_entry == 1]

# check stop_loss and take_profit

returns = price[i] / entry_price

stop = (returns > 1 + abs(take_profit)

) | (returns < 1 - abs(stop_loss))

exit[i] |= stop

# run signal

rank = (entry[i] * ranking[i] + ret[i-1] * 3)

rank[exit[i] == 1] = -1

rank[(entry[i] == 0) & (ret[i-1] == 0)] = -1

ret[i][np.argsort(rank)[-nstocks_limit:]] = 1

ret[i][rank == -1] = 0

return ret

ret = pd.DataFrame(0, index=entry.index, columns=entry.columns)

ret = rotate_stocks(ret.values,

entry.astype(int).values,

exit.astype(int).values,

nstocks_limit,

stop_loss,

take_profit,

price=price.values,

ranking=rank.values)

return pd.DataFrame(ret, index=entry.index, columns=entry.columns)

@functools.lru_cache def calc_disclosure_dates(detail=True):

cinfo = data.get('company_basic_info').copy() cinfo['id'] = cinfo.stock_id.str.split(' ').str[0] cinfo = cinfo.set_index('id') cinfo = cinfo[~cinfo.index.duplicated(keep='last')]

def calc_default_disclosure_dates(s): sid = s.name cat = cinfo.loc[sid].產業類別 if sid in cinfo.index else 'etf' short_name = cinfo.loc[sid].公司簡稱 if sid in cinfo.index else 'etf'

if cat == '金融業':

calendar = {

'1': '-05-15',

'2': '-08-31',

'3': '-11-14',

'4': '-03-31',

}

elif cat == '金融保險業':

calendar = {

'1': '-04-30',

'2': '-08-31',

'3': '-10-31',

'4': '-03-31',

}

elif 'KY' in short_name:

calendar = {

'old':{

'1': '-05-15',

'2': '-08-14',

'3': '-11-14',

'4': '-03-31',

},

'new':{

'1': '-05-15',

'2': '-08-31',

'3': '-11-14',

'4': '-03-31',

},

}

else:

calendar = {

'1': '-05-15',

'2': '-08-14',

'3': '-11-14',

'4': '-03-31',

}

get_year = lambda year, season: str(year) if int(season) != 4 else str(int(year) + 1)

ky_policy_check = lambda year: 'new' if year >= '2021' else 'old'

return pd.to_datetime(s.index.map(lambda d: get_year(d[:4], d[-1]) + calendar[ky_policy_check(d[:4])][d[-1]]) if 'KY' in short_name else s.index.map(lambda d: get_year(d[:4], d[-1]) + calendar[d[-1]]))

def season_end(s):

calendar = {

'1': '-3-31',

'2': '-6-30',

'3': '-9-30',

'4': '-12-31',

}

return pd.to_datetime(s.index.map(lambda d: d[:4] + calendar[d[-1]]))

disclosure_dates = data.get('financial_statements_upload_detail:upload_date') disclosure_dates = disclosure_dates.apply(pd.to_datetime)

financial_season_end = disclosure_dates.apply(season_end) default_disclosure_dates = disclosure_dates.apply(calc_default_disclosure_dates)

disclosure_dates[(disclosure_dates > default_disclosure_dates) | (disclosure_dates < financial_season_end)] = pd.NaT disclosure_dates[(disclosure_dates.diff() <= datetime.timedelta(days=0))] = pd.NaT disclosure_dates.loc['2019-Q1', '3167'] = pd.NaT disclosure_dates.loc['2015-Q1', '5536'] = pd.NaT disclosure_dates.loc['2018-Q1', '5876'] = pd.NaT

disclosure_dates = disclosure_dates.fillna(default_disclosure_dates) disclosure_dates.columns.name = 'stock_id'

if detail: return disclosure_dates return default_disclosure_dates

## 本益成長比(月營收截止日換股)

https://doc.finlab.tw/tools/guide_for_beginners/

```python

from finlab import data

from finlab.backtest import sim

import finlab

finlab.login("cdnE+4n53DXjKkN8J7spHLvPq3xwycL6gfd0PaUL+UDWOAKroWHcXUNsN82ibihU#free")

rev = data.get('monthly_revenue:當月營收')

rev_ma3 = rev.average(3)

rev_ma12 = rev.average(12)

# 營收趨勢多頭策略

cond1 = rev_ma3/rev_ma12 > 1.1

cond2 = rev/rev.shift(1) > 0.9

cond_all = cond1 & cond2

pe = data.get('price_earning_ratio:本益比')

營業利益成長率 = data.get('fundamental_features:營業利益成長率')

# 本益成長比

peg = (pe/營業利益成長率)

# 本益成長比和原訊號相乘,若不持有則相乘後等於0

position = peg*(cond_all)

# 原訊號為0的不要選,若沒加這行且策略只選到7檔,之後還是會選3檔訊號為0(不持有)的補足10檔,執行這行就會排除訊號為0。

position = position[position>0]

# 選股挑本益成長比前10小的

position = position.is_smallest(10)

print(position)

# 月營收截止日換股

position = position.reindex(rev.index_str_to_date().index, method='ffill')

print(position)

input()

report = sim(position=position, name="策略教學範例:peg_rev", stop_loss=0.1, upload=False)

report.display()

股價淨值比

from finlab import data

from finlab.backtest import sim

pb = data.get('price_earning_ratio:股價淨值比')

close = data.get('price:收盤價')

position = (1/(pb * close) * (close > close.average(60)) * (close > 5)).is_largest(20)

report = sim(position, resample='Q',mae_mfe_window=30,mae_mfe_window_step=2)

report.display_mae_mfe_analysis()

is_smallest

import pandas as pd

def is_smallest(df, n):

return df.astype(float).apply(lambda s: s.nsmallest(n), axis=1).reindex_like(df).notna()

df = pd.DataFrame({

'A': [1.2, 2.5, 3.1],

'B': [2.2, 1.8, 5.5],

'C': [3.3, 4.5, 0.7],

'D': [4.4, 5.5, 2.2],

'E': [5.5, 3.3, 4.4]

})

print(df)

result = is_smallest(df, 2)

print(result)

#這個 DataFrame 有 5 列 3 行,包含 15 個浮點數值。現在需要按行找到每行最小的 2 個數值所在的列,將其對應的索引置為 True。

#

#使用以下程式碼進行處理:

#

#複製

#n = 2

#result = df.astype(float).apply(lambda s: s.nsmallest(n), axis=1).reindex_like(df).notna()

#這裡的 n 為 2,在上面的程式碼中,先將 df 轉換為浮點格式,然後按行進行遍歷,對每一行調用 s.nsmallest(n) 函數找到最小的 2 個數值所在的列,其它位置置為 NaN,返回一個 Series 對象。接著把這個 Series 對象與原始 DataFrame 進行重索引,並且補缺失值為 False,最終得到一個與原始 DataFrame 一樣大小的布林值 DataFrame。

#

#執行上述程式之後,可以得到以下結果:

#

#複製

# A B C D E

#0 False True False False False

#1 True False False False True

#2 False True True False False

#這個結果的含義是:

#

#第一行最小的 2 個數值分別位於 B 列,因此 B 列為 True,其餘為 False;

夏普值

出處: https://www.finlab.tw/python%e6%96%b0%e6%89%8b%e6%95%99%e5%ad%b8%ef%bc%9a%e5%a4%8f%e6%99%ae%e6%8c%87%e6%95%b8%e7%ad%96%e7%95%a5/

import yfinance as yf

import pandas as pd

import numpy as np

def crawl_price(stock_id):

stock = yf.Ticker(stock_id)

df = stock.history(period="max")

return df

twii = crawl_price("^TWII")

print(twii)

mean = twii['Close'].pct_change().rolling(252).mean()

std = twii['Close'].pct_change().rolling(252).std()

sharpe = mean / std

# sharpe ratio 平滑

sr = sharpe

srsma = sr.rolling(60).mean()

# sharpe ratio 的斜率

srsmadiff = srsma.diff()

# 計算買入賣出點

buy = (srsmadiff > 0) & (srsmadiff.shift() < 0)

sell = (srsmadiff < 0) & (srsmadiff.shift() > 0)

# 計算持有時間

hold = pd.Series(np.nan, index=buy.index)

hold[buy] = 1

hold[sell] = 0

hold.ffill(inplace=True)

hold.plot()

# 持有時候的績效

adj = twii['Close'][buy.index]

(adj.pct_change().shift(-1)+1).fillna(1)[hold == 1].cumprod().plot()

def backtest(a, b, c, d, plot=False):

sr = sharpe

srsma = sr.rolling(a).mean()

srsmadiff = srsma.diff() * 100

ub = srsmadiff.quantile(b)

lb = srsmadiff.quantile(c)

buy = ((srsmadiff.shift(d) < lb) & (srsmadiff > ub))

sell = ((srsmadiff.shift(d) > ub) & (srsmadiff < lb))

hold = pd.Series(np.nan, index=buy.index)

hold[buy] = 1

hold[sell] = 0

hold.ffill(inplace=True)

adj = twii['Close'][buy.index]

if plot:

(adj.pct_change().shift(-1)+1).fillna(1)[hold == 1].cumprod().plot()

hold.plot()

eq = (adj.pct_change().shift(-1)+1).fillna(1)[hold == 1].cumprod()

if len(eq) > 0:

return eq.iloc[-1]

else:

return 1

maxeq = 0

for a in range(100,200,20):

for b in np.arange(0.3, 0.9, 0.03):

for c in np.arange(0.3, 0.6, 0.03):

for d in range(60, 180, 10):

eq = backtest(a,b,c,d)

if maxeq < eq:

maxeq = eq

print(eq, a,b,c,d)