backtrader resample過程

如何將一個小週期的data 轉換成一個大週期的data?具體如何操作,這個在BT裡面使用resample 完成的。例如days轉換成weeks?

data = btfeeds.BacktraderCSVData(dataname=datapath)

cerebro.adddata(data) # First add the original data - smaller timeframe

cerebro.resampledata(data, timeframe=tframes[args.timeframe],

compression=args.compression)

會自動在datas裡面新增這2個data,第二個data在第一個data的基礎上,進行資料的resample.

這裡需要注意:

timeframe:壓縮的週期,只能比被壓縮的資料週期大,當前資料週期是days,那麼timeframe可以是weeks,M,year等。

compression:一個timeframe壓縮成多少個bar,一般是1。當前是5個days bar壓縮成一個week bar.

資料壓縮的過程:

當前的data無法進行一次性的preload,linebuffer 每次向前移動一個單位長度,即每次讀取data的一個資料,然後每次checkover一下是否集齊5根bar:

def _checkbarover(self, data, fromcheck=False, forcedata=None):

chkdata = DTFaker(data, forcedata) if fromcheck else data

isover = False

if not self.componly and not self._barover(chkdata):

return isover

if self.subdays and self.p.bar2edge:

isover = True

elif not fromcheck: # fromcheck doesn't increase compcount

self.compcount += 1

if not (self.compcount % self.p.compression):

# boundary crossed and enough bars for compression ... proceed

isover = True

return isover

當完成一個週期的壓縮後,isover是true。

資料的壓縮演算法_bar 裡面的:

def bupdate(self, data, reopen=False):

'''Updates a bar with the values from data

Returns True if the update was the 1st on a bar (just opened)

Returns False otherwise

'''

if reopen:

self.bstart()

self.datetime = data.datetime[0]

self.high = max(self.high, data.high[0])

self.low = min(self.low, data.low[0])

self.close = data.close[0]

self.volume += data.volume[0]

self.openinterest = data.openinterest[0]

o = self.open

if reopen or not o == o:

self.open = data.open[0]

return True # just opened the bar

return False

壓縮完成的資料存放在:

for i, dti in enumerate(dts):

if dti is not None:

di = datas[i]

rpi = False and di.replaying # to check behavior

if dti > dt0:

if not rpi: # must see all ticks ...

di.rewind() # cannot deliver yet

# self._plotfillers[i].append(slen)

elif not di.replaying:

# Replay forces tick fill, else force here

di._tick_fill(force=True)

di._tick_fill:完成對一個bar的填充。

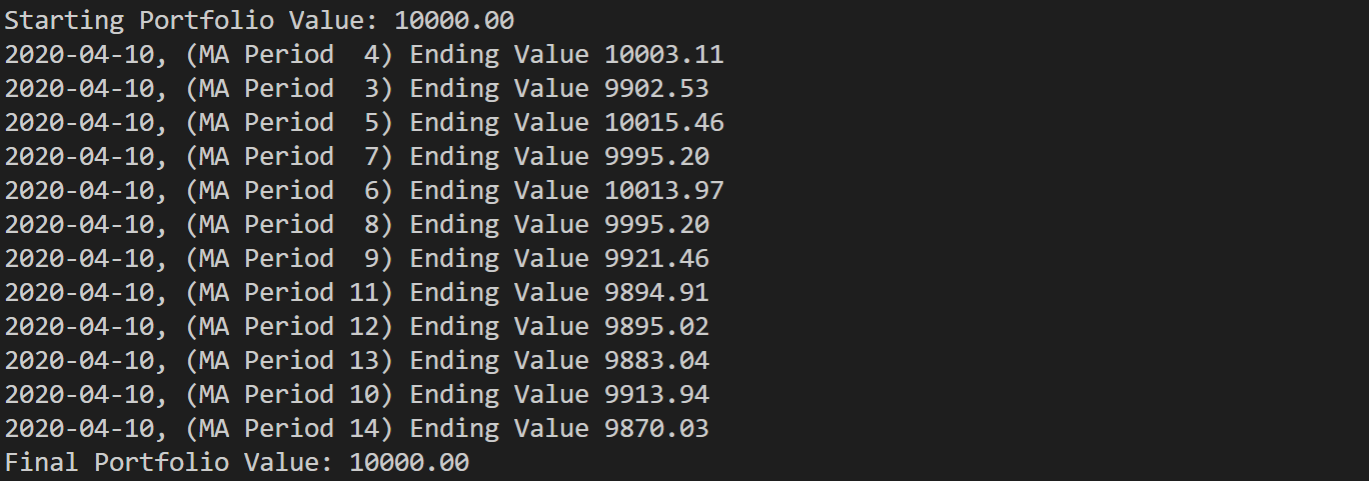

量化交易回測框架Backtrader使用optstrategy最佳化

給策略增加指標後,需要給你指標設定參數,比如SMA設定幾天合適呢,每個股票的週期又都不一樣。總不能一個一個的自己嘗試。Backtrader提供了一個參數最佳化的方法,可以按照給出的範圍來運行,大家可以根據結果尋找最優的均線天數。具體可以參看Backtrader官方文件quickstart

- 通過給策略一個範圍值,根據運行結果,找出某適合一隻股票的盤整週期。

通過optstrategy方法,給策略設定範圍值,讓策略逐個執行,對比結果。

"""

Created on Sun Mar 29 12:18:17 2020

@author: horace pei

"""

#############################################################

# import

#############################################################

from __future__ import absolute_import, division, print_function, unicode_literals

import os, sys

import pandas as pd

import backtrader as bt

#############################################################

# global const values

#############################################################

#############################################################

# static function

#############################################################

#############################################################

# class

#############################################################

# Create a Stratey

class TestStrategy(bt.Strategy):

# 自訂均線的實踐間隔,默認是5天

params = (

("maperiod", 5),

("printlog", False),

)

def log(self, txt, dt=None, doprint=False):

""" Logging function for this strategy"""

if self.params.printlog or doprint:

dt = dt or self.datas[0].datetime.date(0)

print("%s, %s" % (dt.isoformat(), txt))

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

# To keep track of pending orders

self.order = None

# buy price

self.buyprice = None

# buy commission

self.buycomm = None

# 增加均線,簡單移動平均線(SMA)又稱“算術移動平均線”,是指對特定期間的收盤價進行簡單平均化

self.sma = bt.indicators.SimpleMovingAverage(

self.datas[0], period=self.params.maperiod

)

# 訂單狀態改變回呼方法 be notified through notify_order(order) of any status change in an order

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# Check if an order has been completed

# Attention: broker could reject order if not enough cash

if order.status in [order.Completed]:

if order.isbuy():

self.log(

"BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

self.buyprice = order.executed.price

self.buycomm = order.executed.comm

elif order.issell():

self.log(

"SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

self.bar_executed = len(self)

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log("Order Canceled/Margin/Rejected")

# Write down: no pending order

self.order = None

# 交易狀態改變回呼方法 be notified through notify_trade(trade) of any opening/updating/closing trade

def notify_trade(self, trade):

if not trade.isclosed:

return

# 每筆交易收益 毛利和淨利

self.log("OPERATION PROFIT, GROSS %.2f, NET %.2f" % (trade.pnl, trade.pnlcomm))

def next(self):

# Simply log the closing price of the series from the reference

self.log("Close, %.2f" % self.dataclose[0])

# Check if an order is pending ... if yes, we cannot send a 2nd one

if self.order:

return

# Check if we are in the market(當前帳戶持股情況,size,price等等)

if not self.position:

# Not yet ... we MIGHT BUY if ...

if self.dataclose[0] >= self.sma[0]:

# 當收盤價,大於等於均線的價格

# BUY, BUY, BUY!!! (with all possible default parameters)

self.log("BUY CREATE, %.2f" % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.buy()

else:

# Already in the market ... we might sell

if self.dataclose[0] < self.sma[0]:

# 當收盤價,小於均線價格

# SELL, SELL, SELL!!! (with all possible default parameters)

self.log("SELL CREATE, %.2f" % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.sell()

def stop(self):

self.log(

"(MA Period %2d) Ending Value %.2f"

% (self.params.maperiod, self.broker.getvalue()),

doprint=True,

)

#############################################################

# global values

#############################################################

#############################################################

# global function

#############################################################

def get_dataframe():

# Get a pandas dataframe

datapath = "./data/stockinfo.csv"

tmpdatapath = "./data/stockinfo_tmp.csv"

print("-----------------------read csv---------------------------")

dataframe = pd.read_csv(

datapath, skiprows=0, header=0, parse_dates=True, index_col=0

)

dataframe.trade_date = pd.to_datetime(dataframe.trade_date, format="%Y%m%d")

dataframe["openinterest"] = "0"

feedsdf = dataframe[

["trade_date", "open", "high", "low", "close", "vol", "openinterest"]

]

feedsdf.columns = [

"datetime",

"open",

"high",

"low",

"close",

"volume",

"openinterest",

]

feedsdf.set_index(keys="datetime", inplace=True)

feedsdf.iloc[::-1].to_csv(tmpdatapath)

feedsdf = pd.read_csv(

tmpdatapath, skiprows=0, header=0, parse_dates=True, index_col=0

)

if os.path.isfile(tmpdatapath):

os.remove(tmpdatapath)

print(tmpdatapath + " removed!")

return feedsdf

########################################################################

# main

########################################################################

if __name__ == "__main__":

# Create a cerebro entity(建立cerebro)

cerebro = bt.Cerebro()

# Add a strategy(加入自訂策略,可以設定自訂參數,方便調節)

cerebro.optstrategy(TestStrategy, maperiod=range(3, 15))

# Get a pandas dataframe(獲取dataframe格式股票資料)

feedsdf = get_dataframe()

# Pass it to the backtrader datafeed and add it to the cerebro(加入資料)

data = bt.feeds.PandasData(dataname=feedsdf)

cerebro.adddata(data)

# Add a FixedSize sizer according to the stake(國內1手是100股,最小的交易單位)

cerebro.addsizer(bt.sizers.FixedSize, stake=100)

# Set our desired cash start(給經紀人,可以理解為交易所股票帳戶充錢)

cerebro.broker.setcash(10000.0)

# Set the commission - 0.1%(設定交易手續費,雙向收取)

cerebro.broker.setcommission(commission=0.001)

# Print out the starting conditions(輸出帳戶金額)

print("Starting Portfolio Value: %.2f" % cerebro.broker.getvalue())

# Run over everything(執行回測)

cerebro.run()

# Print out the final result(輸出帳戶金額)

print("Final Portfolio Value: %.2f" % cerebro.broker.getvalue())

分析和說明

通過: cerebro.optstrategy(TestStrategy, maperiod=range(3,15)),來設定3到15天的均線,看看均線時間那個收益最好。

追高進場與加碼,固定停損停利,計算固定資金的數量

from __future__ import absolute_import, division, print_function, unicode_literals

from math import e

import yfinance as yf

import pyfolio

import backtrader as bt

import numpy as np

import warnings

import pandas as pd

warnings.filterwarnings("ignore")

# 計算固定資金的數量

class FixedCash(bt.Sizer):

def __init__(self, cash=10000):

self.cash = cash

def _getsizing(self, comminfo, cash, data, isbuy):

print(self.cash // data.close[0], data.close[0])

if isbuy:

return self.cash // data.close[0] # 向下取整得到可買入的數量

else:

return self.broker.getposition(data).size # 返回持倉數量

# 固定數量

class FixedSize(bt.Sizer):

def __init__(self, stake=10000):

self.stake = stake

def _getsizing(self, comminfo, cash, data, isbuy):

return self.stake

# 買總總金%數量

class DynamicRiskSizer(bt.Sizer):

def _getsizing(self, comminfo, cash, data, isbuy):

# 查詢當前交易賬戶的總價值

total_value = self.broker.get_value()

# 計算每個交易的交易量

trade_value = total_value * 0.01 # 每個交易的風險百分比為1%

risk = (

data.close[0] - data.close[-1] if isbuy else data.close[-1] - data.close[0]

)

trade_size = trade_value / abs(risk)

return int(trade_size)

# 建立一個backtrader回測框架

class Highest_high(bt.Strategy):

# 設置sma的參數,根據官方照此設置可進行暴力演算,得知何種參數最佳

params = (

("highest", 6),

("in_amount", 4),

("stoploss", 0.1),

("takeprofit", 0.2),

)

# 這裡是log,當交易發生時呼叫log函數可以將交易print出來

def log(self, txt, dt=None):

""" Logging function fot this strategy"""

dt = dt or self.datas[0].datetime.date(0)

# print('%s, %s' % (dt.isoformat(), txt))

# init定義你會用到的數據

def __init__(self):

# 呼叫high序列備用

self.datahigh = self.datas[0].high

# 呼叫close序列備用

self.dataclose = self.datas[0].close

# 追蹤order、buyprice跟buycomm使用,可用可不用

self.order = None

self.buyprice = None

self.buycomm = None

# 使用指標套件給的最高價判斷函數Highest

self.the_highest_high = bt.ind.Highest(

self.datahigh, period=self.params.highest

)

# notify_order當每次有訂單由next偵測出來的條件送出時,會觸發notify_order,好處是顯示出訂單執行的狀況以及偵測是否有資金不足的情況

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# 當訂單為提交狀態時則不做任何事

return

# 當訂單完成時,若為Buy則print出買入狀況;反之亦然

if order.status in [order.Completed]:

if order.isbuy():

self.log(

"BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

self.buyprice = order.executed.price

self.buycomm = order.executed.comm

else:

self.log(

"SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

# 當因策略取消或是現今不足訂單被拒絕等狀況則print出訂單取消

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log("Order Canceled/Margin/Rejected")

# 完成該有的提醒之後則將oder設置回None

self.order = None

# notify_trade交易通知,預設如果有倉在手就不做事,如果執行賣出則print出獲利

def notify_trade(self, trade):

if not trade.isclosed:

return

self.log("OPERATION PROFIT, GROSS %.2f, NET %.2f" % (trade.pnl, trade.pnlcomm))

# next可以把它想像成一個內建的for loop,他把數據打包好供我們使用

def next(self):

# 獲取當前日期和股票的收盤價格

date = self.datas[0].datetime.date(0).isoformat()

close = self.datas[0].close[0]

# 檢查有無pending的訂單

if self.order:

return

# self.position.size獲得目前倉位資訊,當size<指定進場次數時則允許買入

if self.position.size < self.params.in_amount * 1000:

# 當現在的高大於前面n根的最高價時準備執行買入

if self.datahigh > self.the_highest_high[-1]:

# 紀錄買單提交

self.log("BUY CREATE, %.2f" % self.dataclose[0])

# 買進

self.order = self.buy()

# 當庫存部位不為0但表有庫存

if self.position.size != 0:

# 獲取庫存成本

costs = self.position.price

# 當收盤價大於平均成本的10%停利賣出

if self.dataclose[0] > costs + (costs * self.params.takeprofit):

self.close()

self.log("Take Profit, %.2f" % self.dataclose[0])

# 當收盤價小於平均成本

elif self.dataclose[0] < costs - (costs * self.params.stoploss):

self.close()

self.log("Stop Loss, %.2f" % self.dataclose[0])

print(

f"Date: {date}, Closing:{close}, holding of shares:{self.position.size}, total captial:{self.broker.get_value()}"

)

input()

# #回測終止時print出結果

# def stop(self):

# print(f'Fast MA: {self.params.fast_period} | Slow MA: {self.params.slow_period} | End Value: {self.broker.getvalue()}')

if __name__ == "__main__":

# 創建框架

cerebro = bt.Cerebro()

# # 放入策略

# cerebro.addstrategy(Highest_high)

# # 放入策略

cerebro.optstrategy(

Highest_high,

highest=range(5, 9),

in_amount=range(1, 5),

stoploss=np.arange(0.1, 0.5, 0.1),

takeprofit=np.arange(0.1, 0.5, 0.1),

)

# 使用框架的資料取得函數

data = bt.feeds.PandasData(

dataname=yf.download("2317.TW", "2014-01-01", "2023-01-01")

)

# 將datafeed餵入框架

cerebro.adddata(data)

# 設置起始金額

cerebro.broker.setcash(1000000.0)

# 設置一次購買的股數,臺股以1000股為主

# cerebro.addsizer(bt.sizers.SizerFix, stake=1000)

cerebro.addsizer(FixedCash)

# 設置傭金,稍微設置高一點作為滑價付出成本

cerebro.broker.setcommission(commission=0.0015)

# ===================Pyfolio===================

# cerebro.addanalyzer(bt.analyzers.PyFolio, _name='pyfolio')

# 在設置完傭金、起始金額以及買入股數之後,我們加入三種分析

cerebro.addanalyzer(bt.analyzers.SharpeRatio)

cerebro.addanalyzer(bt.analyzers.Returns)

cerebro.addanalyzer(bt.analyzers.DrawDown)

results = cerebro.run(maxcpus=1)

# 準備list存放每一個參數及結果

par1, par2, par3, par4, ret, down, sharpe_r = [], [], [], [], [], [], []

# 迴圈每一個結果

for strat in results:

# 因為結果是用list包起來(範例在下註解),所以我們要[0]取值

# [<backtrader.cerebro.OptReturn object at 0x0000024FF9717CC8>]

strat = strat[0]

# get_analysis()獲得值

a_return = strat.analyzers.returns.get_analysis()

drawDown = strat.analyzers.drawdown.get_analysis()

sharpe = strat.analyzers.sharperatio.get_analysis()

# 依序裝入資料,可用strat.params.xx獲取參數

par1.append(strat.params.highest)

par2.append(strat.params.in_amount)

par3.append(strat.params.stoploss)

par4.append(strat.params.takeprofit)

# rtot代表總回報,獲取總回報

ret.append(a_return["rtot"])

# 我們關注最大的drawdown,因此如下取值

down.append(drawDown["max"]["drawdown"])

# 獲取sharpe ratio

sharpe_r.append(sharpe["sharperatio"])

# 組裝成dataframe

result_df = pd.DataFrame()

result_df["Highest"] = par1

result_df["in_amount"] = par2

result_df["stoploss"] = par3

result_df["takeprofit"] = par4

result_df["total profit"] = ret

result_df["Max Drawdown"] = down

result_df["Sharpe Ratio"] = sharpe_r

# 根據總報酬來排列

result_df = result_df.sort_values(by=["total profit"], ascending=False)

print(result_df)

# 畫Kbars

# cerebro.plot(style='candlestick', barup='red', bardown='green')

# ===================Pyfolio===================

# strat = results[0]

# pyfoliozer = strat.analyzers.getbyname('pyfolio')

# returns, positions, transactions, gross_lev = pyfoliozer.get_pf_items()

# # # pyfolio showtime

# import pyfolio as pf

# pf.create_full_tear_sheet(

# returns,

# positions=positions,

# transactions=transactions,

# live_start_date='2018-01-01') # This date is sample specific)

追高進場與加碼,固定停損停利

from __future__ import absolute_import, division, print_function, unicode_literals

import datetime

from math import e

import yfinance as yf

import os.path

import sys

import pyfolio

import backtrader as bt

import numpy as np

import warnings

import pandas as pd

warnings.filterwarnings("ignore")

# 建立一個backtrader回測框架

class Highest_high(bt.Strategy):

# 設置sma的參數,根據官方照此設置可進行暴力演算,得知何種參數最佳

params = (

("highest", 6),

("in_amount", 4),

("stoploss", 0.1),

("takeprofit", 0.2),

)

# 這裡是log,當交易發生時呼叫log函數可以將交易print出來

def log(self, txt, dt=None):

""" Logging function fot this strategy"""

dt = dt or self.datas[0].datetime.date(0)

# print('%s, %s' % (dt.isoformat(), txt))

# init定義你會用到的數據

def __init__(self):

# 呼叫high序列備用

self.datahigh = self.datas[0].high

# 呼叫close序列備用

self.dataclose = self.datas[0].close

# 追蹤order、buyprice跟buycomm使用,可用可不用

self.order = None

self.buyprice = None

self.buycomm = None

# 使用指標套件給的最高價判斷函數Highest

self.the_highest_high = bt.ind.Highest(

self.datahigh, period=self.params.highest

)

# notify_order當每次有訂單由next偵測出來的條件送出時,會觸發notify_order,好處是顯示出訂單執行的狀況以及偵測是否有資金不足的情況

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# 當訂單為提交狀態時則不做任何事

return

# 當訂單完成時,若為Buy則print出買入狀況;反之亦然

if order.status in [order.Completed]:

if order.isbuy():

self.log(

"BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

self.buyprice = order.executed.price

self.buycomm = order.executed.comm

else:

self.log(

"SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

# 當因策略取消或是現今不足訂單被拒絕等狀況則print出訂單取消

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log("Order Canceled/Margin/Rejected")

# 完成該有的提醒之後則將oder設置回None

self.order = None

# notify_trade交易通知,預設如果有倉在手就不做事,如果執行賣出則print出獲利

def notify_trade(self, trade):

if not trade.isclosed:

return

self.log("OPERATION PROFIT, GROSS %.2f, NET %.2f" % (trade.pnl, trade.pnlcomm))

# next可以把它想像成一個內建的for loop,他把數據打包好供我們使用

def next(self):

# 檢查有無pending的訂單

print(

f"holding of shares:{self.position.size}, total captial:{self.broker.get_value()}"

)

if self.order:

return

# self.position.size獲得目前倉位資訊,當size<指定進場次數時則允許買入

if self.position.size < self.params.in_amount * 1000:

# 當現在的高大於前面n根的最高價時準備執行買入

if self.datahigh > self.the_highest_high[-1]:

# 紀錄買單提交

self.log("BUY CREATE, %.2f" % self.dataclose[0])

# 買進

self.order = self.buy()

# 當庫存部位不為0但表有庫存

if self.position.size != 0:

# 獲取庫存成本

costs = self.position.price

# 當收盤價大於平均成本的10%停利賣出

if self.dataclose[0] > costs + (costs * self.params.takeprofit):

self.close()

self.log("Take Profit, %.2f" % self.dataclose[0])

# 當收盤價小於平均成本

elif self.dataclose[0] < costs - (costs * self.params.stoploss):

self.close()

self.log("Stop Loss, %.2f" % self.dataclose[0])

# #回測終止時print出結果

# def stop(self):

# print(f'Fast MA: {self.params.fast_period} | Slow MA: {self.params.slow_period} | End Value: {self.broker.getvalue()}')

if __name__ == "__main__":

# 創建框架

cerebro = bt.Cerebro()

# # 放入策略

# cerebro.addstrategy(Highest_high)

# # 放入策略

cerebro.optstrategy(

Highest_high,

highest=range(5, 9),

in_amount=range(1, 5),

stoploss=np.arange(0.1, 0.5, 0.1),

takeprofit=np.arange(0.1, 0.5, 0.1),

)

# 使用框架的資料取得函數

data = bt.feeds.PandasData(

dataname=yf.download("2317.TW", "2014-01-01", "2023-01-01")

)

# 將datafeed餵入框架

cerebro.adddata(data)

# 設置起始金額

cerebro.broker.setcash(1000000.0)

# 設置一次購買的股數,臺股以1000股為主

cerebro.addsizer(bt.sizers.SizerFix, stake=1000)

# 設置傭金,稍微設置高一點作為滑價付出成本

cerebro.broker.setcommission(commission=0.0015)

# ===================Pyfolio===================

# cerebro.addanalyzer(bt.analyzers.PyFolio, _name='pyfolio')

# 在設置完傭金、起始金額以及買入股數之後,我們加入三種分析

cerebro.addanalyzer(bt.analyzers.SharpeRatio)

cerebro.addanalyzer(bt.analyzers.Returns)

cerebro.addanalyzer(bt.analyzers.DrawDown)

results = cerebro.run(maxcpus=1)

# 準備list存放每一個參數及結果

par1, par2, par3, par4, ret, down, sharpe_r = [], [], [], [], [], [], []

# 迴圈每一個結果

for strat in results:

# 因為結果是用list包起來(範例在下註解),所以我們要[0]取值

# [<backtrader.cerebro.OptReturn object at 0x0000024FF9717CC8>]

strat = strat[0]

# get_analysis()獲得值

a_return = strat.analyzers.returns.get_analysis()

drawDown = strat.analyzers.drawdown.get_analysis()

sharpe = strat.analyzers.sharperatio.get_analysis()

# 依序裝入資料,可用strat.params.xx獲取參數

par1.append(strat.params.highest)

par2.append(strat.params.in_amount)

par3.append(strat.params.stoploss)

par4.append(strat.params.takeprofit)

# rtot代表總回報,獲取總回報

ret.append(a_return["rtot"])

# 我們關注最大的drawdown,因此如下取值

down.append(drawDown["max"]["drawdown"])

# 獲取sharpe ratio

sharpe_r.append(sharpe["sharperatio"])

# 組裝成dataframe

result_df = pd.DataFrame()

result_df["Highest"] = par1

result_df["in_amount"] = par2

result_df["stoploss"] = par3

result_df["takeprofit"] = par4

result_df["total profit"] = ret

result_df["Max Drawdown"] = down

result_df["Sharpe Ratio"] = sharpe_r

# 根據總報酬來排列

result_df = result_df.sort_values(by=["total profit"], ascending=False)

print(result_df)

# 畫Kbars

# cerebro.plot(style='candlestick', barup='red', bardown='green')

# ===================Pyfolio===================

# strat = results[0]

# pyfoliozer = strat.analyzers.getbyname('pyfolio')

# returns, positions, transactions, gross_lev = pyfoliozer.get_pf_items()

# # # pyfolio showtime

# import pyfolio as pf

# pf.create_full_tear_sheet(

# returns,

# positions=positions,

# transactions=transactions,

# live_start_date='2018-01-01') # This date is sample specific)

import backtrader as bt

import yfinance as yf

class MyStrategy(bt.Strategy):

# 設定MA均線的週期

params = (

('ma10', 10),

('ma20', 20),

('ma40', 40),

('take_profit', 0.2), # 設定獲利目標為20%

)

def __init__(self):

self.ma10 = bt.indicators.MovingAverageSimple(self.data.close, period=self.params.ma10)

self.ma20 = bt.indicators.MovingAverageSimple(self.data.close, period=self.params.ma20)

self.ma40 = bt.indicators.MovingAverageSimple(self.data.close, period=self.params.ma40)

def next(self):

# 如果當前價格低於MA10,就買入一次

if self.data.close[0] < self.ma10[0]:

self.buy(size=1)

# 如果當前價格低於MA20,再買入一次

if self.data.close[0] < self.ma20[0]:

self.buy(size=1)

# 如果當前價格低於MA40,就停止交易並止損

if self.data.close[0] < self.ma40[0]:

self.close()

# 如果當前有持倉,計算當前持倉的盈利百分比

if self.position:

profit = (self.data.close[0] - self.position.price) / self.position.price

# 如果當前持倉的盈利達到設定的獲利目標,就賣出並止盈

if profit >= self.params.take_profit:

self.close()

cerebro = bt.Cerebro()

# 設定初始資金為10000美元

cerebro.broker.setcash(10000)

data = bt.feeds.PandasData(dataname=yf.download("MSFT", "2011-01-01", "2023-01-01"))

# 將數據傳入Cerebro中

cerebro.adddata(data)

# 將策略傳入Cerebro中

cerebro.addstrategy(MyStrategy)

# 運行回測

cerebro.run()

# 打印最終資金餘額

print('Final Balance: %.2f' % cerebro.broker.getvalue())

from datetime import datetime

import pandas as pd

import backtrader as bt

import yfinance as yf

# 匯入pyfolio 包

import pyfolio as pf

# 建立策略類

class SmaCross(bt.Strategy):

# 定義參數

params = (

("ma10", 10),

("ma20", 20),

("ma40", 40),

("take_profit", 0.2), # 設定獲利目標為20%

)

# 日誌函數

def log(self, txt, dt=None):

"""日誌函數"""

dt = dt or self.datas[0].datetime.date(0)

print("%s, %s" % (dt.isoformat(), txt))

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# 訂單狀態 submitted/accepted,無動作

return

# 訂單完成

if order.status in [order.Completed]:

if order.isbuy():

self.log("買單執行, %.2f" % order.executed.price)

elif order.issell():

self.log("賣單執行, %.2f" % order.executed.price)

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log("訂單 Canceled/Margin/Rejected")

# 記錄交易收益情況(可省略,默認不輸出結果)

def notify_trade(self, trade):

if trade.isclosed:

print(

"毛收益 %0.2f, 扣傭後收益 % 0.2f, 佣金 %.2f"

% (trade.pnl, trade.pnlcomm, trade.commission)

)

def __init__(self):

self.ma10 = bt.indicators.MovingAverageSimple(

self.data.close, period=self.params.ma10

)

self.ma20 = bt.indicators.MovingAverageSimple(

self.data.close, period=self.params.ma20

)

self.ma40 = bt.indicators.MovingAverageSimple(

self.data.close, period=self.params.ma40

)

def __bt_to_pandas__(self, btdata, len):

get = lambda mydata: mydata.get(ago=0, size=len)

fields = {

"open": get(btdata.open),

"high": get(btdata.high),

"low": get(btdata.low),

"close": get(btdata.close),

"volume": get(btdata.volume),

}

time = [btdata.num2date(x) for x in get(btdata.datetime)]

return pd.DataFrame(data=fields, index=time)

def next(self):

data = self.__bt_to_pandas__(self.datas[1], len(self.datas[1]))

cash = self.broker.cash

# print('剩餘現金:', cash)

# print(data)

# Get the current position

pos = self.getposition()

# Get the position size, 股數

size = pos.size

print(

f"size:{size}, close:{self.data.close[0]}, ma10:{self.ma10[0]}, ma20:{self.ma20[0]}, ma40:{self.ma40[0]}, cash:{cash}"

)

# 如果當前價格低於MA10,就買入一次

if self.data.close[0] < self.ma10[0] and size < 200:

self.buy(size=10)

print("close < ma10")

# 如果當前價格低於MA20,再買入一次

if self.data.close[0] < self.ma20[0] and size < 200:

self.buy(size=10)

print("close < ma20")

# 如果當前有持倉,計算當前持倉的盈利百分比

if self.position:

# 如果當前價格低於MA40,就停止交易並止損

if self.data.close[0] < self.ma40[0]:

self.close()

profit = (self.data.close[0] - self.position.price) / self.position.price

# 如果當前持倉的盈利達到設定的獲利目標,就賣出並止盈

if profit >= self.params.take_profit:

self.close()

##########################

# 主程序開始

#########################

# 建立大腦引擎對象

cerebro = bt.Cerebro()

# 建立行情資料對象,載入資料

# data = bt.feeds.PandasData(dataname=yf.download("MSFT", "2011-01-01", "2023-01-01"))

data = bt.feeds.PandasData(dataname=yf.download("2330.TW", "2011-01-01", "2023-01-01"))

# print(yf.download("MSFT", "2011-01-01", "2023-01-01"), type(yf.download("MSFT", "2011-01-01", "2023-01-01")))

# input()

# self.datas[0] 日K數據, self.datas[1] 月K數據

data = cerebro.resampledata(data, timeframe=bt.TimeFrame.Months, compression=1)

cerebro.adddata(data) # 將行情資料對象注入引擎

cerebro.addstrategy(SmaCross) # 將策略注入引擎

cerebro.broker.setcash(10000.0) # 設定初始資金

# 加入pyfolio分析者

cerebro.addanalyzer(bt.analyzers.PyFolio, _name="pyfolio")

results = cerebro.run() # 運行

strat = results[0]

pyfoliozer = strat.analyzers.getbyname("pyfolio")

returns, positions, transactions, gross_lev = pyfoliozer.get_pf_items()

pf.create_full_tear_sheet(returns)