Observers模組

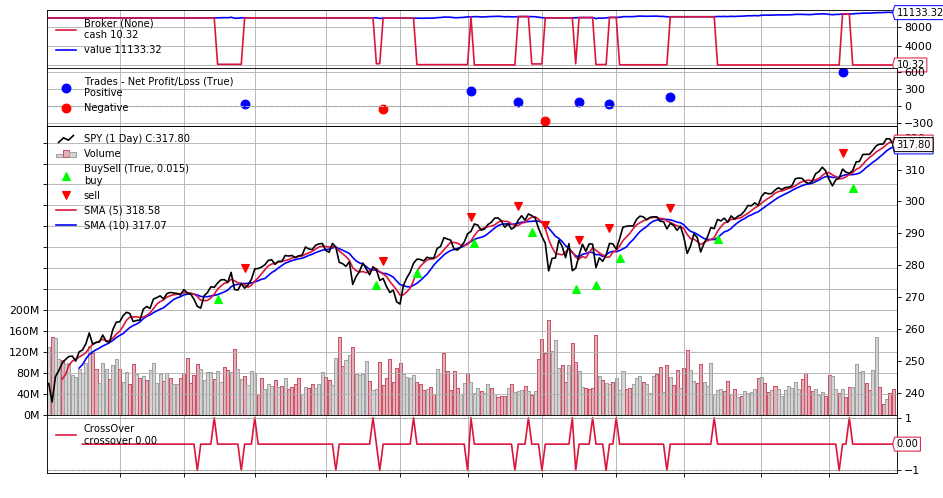

還記得在Day10均線交叉策略看到的這張圖嗎?從上到下分成4個區塊(Cash and Value/Trade/BuySell/CrossOver),之前有分別講一下這4個區塊的功能,這篇則是說明這些區塊是怎麼呼叫出來的,以及這些區塊是否可以增加更多資訊或是刪減一些區塊。

先來看一下document:

All backtrader sample charts have so far had 3 things plotted which seem to be taken for granted because they are not declared anywhere:

- Cash and Value (what’s happening with the money in the broker)

- Trades (aka Operations)

- Buy/Sell Orders

They are Observers and exist within the submodule backtrader.observers. They are there because Cerebro supports a parameter to automatically add (or not) them to the Strategy:

stdstats (default: True)

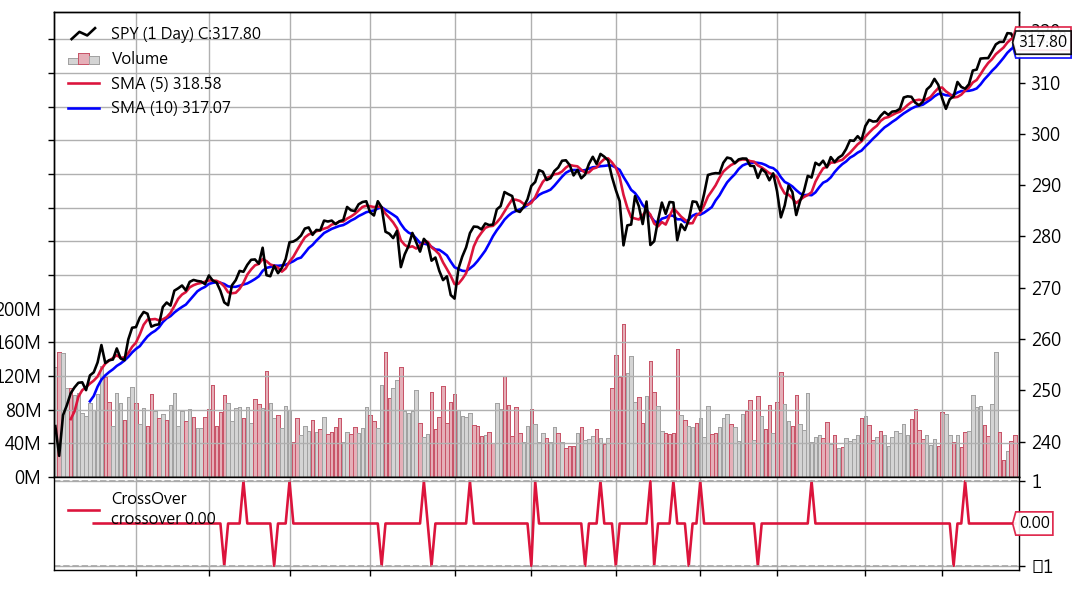

所以如果要把Cash & Value/Trades/BuySell的內容刪除,只要在cerebro的部份修改成下面這行就好:

cerebro = bt.Cerebro(stdstats=False)

就會得到下面這張圖,只剩下股價走勢、長短均線、均線交叉訊號。

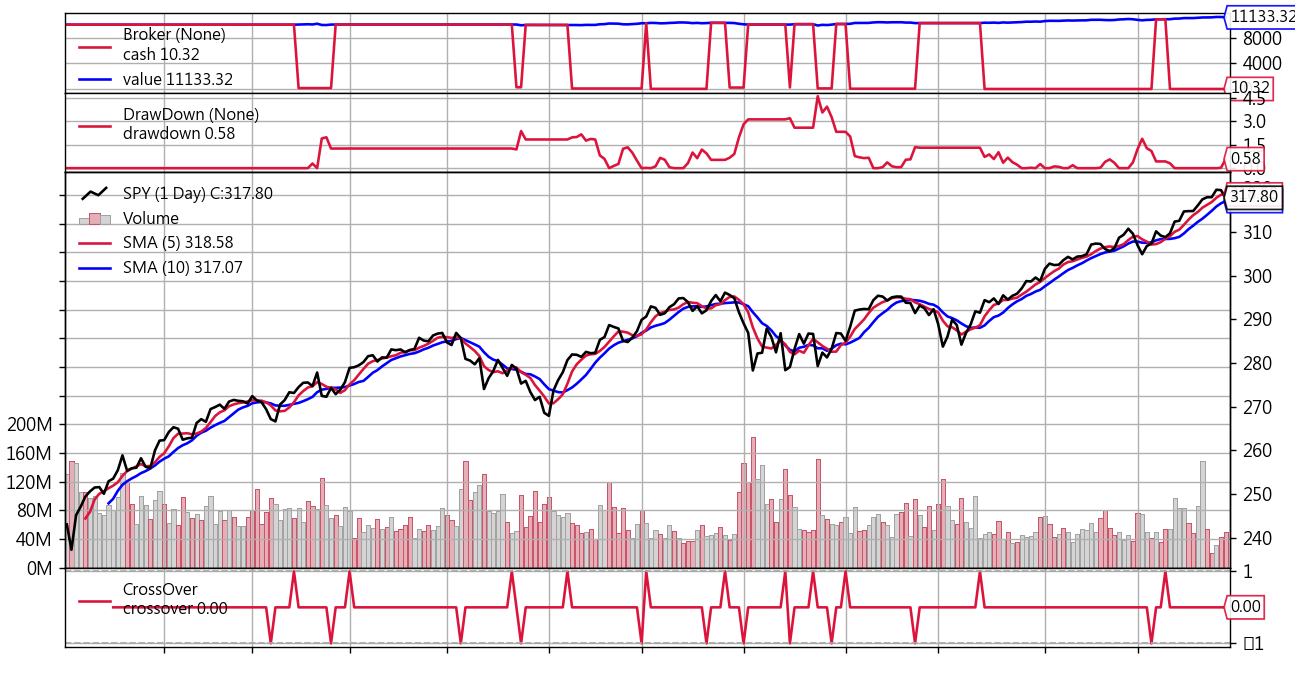

那如果想要把Cash & Value的部份也納入觀察,可以單獨增加這個區塊,只要在cerebro的部份改成:

import math

cerebro = bt.Cerebro(stdstats=False)

# 加上下面這一行

cerebro.addobserver(bt.observers.Broker)

cerebro.adddata(data)

cerebro.addstrategy(SmaCross)

cerebro.run()

cerebro.plot()

或是再加上DrawDown圖(每日損失):

...

cerebro.addobserver(bt.observers.Broker)

# 加上下面這行

cerebro.addobserver(bt.observers.DrawDown)

...

如果想把Drawdown的部份,用文字印出來,則可以在strategy的部份,加上兩行code:

class SmaCross(bt.Strategy):

...

def next(self):

...

# 加上下面這兩行

self.log('DrawDown: %.2f' % self.stats.drawdown.drawdown[-1])

self.log('MaxDrawDown: %.2f' % self.stats.drawdown.maxdrawdown[-1])

...

執行回測時就會印出每日DrawDon及MaxDrawDown,如下

2019-01-16, DrawDown: 0.00

2019-01-16, MaxDrawDown: 0.00

2019-01-17, DrawDown: 0.00

2019-01-17, MaxDrawDown: 0.00

...

2019-03-29, DrawDown: 1.26

2019-03-29, MaxDrawDown: 1.97

2019-04-01, DrawDown: 1.26

2019-04-01, MaxDrawDown: 1.97

...

2019-12-27, DrawDown: 0.00

2019-12-27, MaxDrawDown: 4.60

2019-12-30, DrawDown: 0.00

2019-12-30, MaxDrawDown: 4.60

從上面幾個例子來看,backtrader可以根據個人需求去調整觀測數據的模板,算是蠻彈性的機制,因為不同策略要看的指標往往會有些不同。

本篇總結 那這篇就先寫到這,backtrader這幾篇寫了交易策略、下單部位控制、數據觀測模板,接下來就可以來介紹python串接券商API下單,因為我自己是用IB(Interactive Brokers)交易,所以會以IB的API作為範例,請繼續收看囉。